Finally, a comprehensive guide to measuring private equity value creation, the right way!

ValueBridge.net helps busy analysts build defensible private equity value creation models in minutes

ValueBridge.net measures how private equity returns are driven by changes in portfolio company P&Ls, capital structures, and broader market conditions. This helps GPs explain why their investment approaches are differentiated and helps LPs measure whether those narratives are supported by the numbers.

Watch a 3-minute platform demo

Subscribe today to save 33% on an Analyst Edition subscription, including full access to available video instruction, Excel templates, online calculators, module notes, references, case studies, community forums, and support.

HURRY! OFFER EXPIRES ON MARCH 31, 2024!

Measure value driven by:

Company performance

- EBITDA, gross profit, revenue

- Margins, operating expenses

Capital structures

- Leverage effect, gearing

- Equity dilution

- Valuation

Broader market forces

- Market valuation multiples

- Addressable market changes

- Sector leverage levels

- Foreign exchange rates

Financing activities

- Equity inflows and outflows

- Debt financing

- Add-on acquisitions

- Dividend recapitalizations

Start from one of 40 different private equity value creation models

Stop reinventing the wheel! Save time by leveraging private equity value creation models that are already optimized for your applications. All 40 ValueBridge.net Modules are searchable and can be filtered by categories and value creation metrics. The math works for investments that are levered or unlevered, buyout or growth, majority or minority, 10x or 0.1x. Best of all, the models run on numbers already available in fund reporting and marketing materials. Each Module includes:

Video Instruction

Learn exactly which equations to use, where to find data, and how to set up your spreadsheets, all in about 5-6 minutes.

Excel Templates

Save time by starting with pre-built Microsoft Excel templates that are already optimized for your application.

Online Calculators

Ensure that your models are correct by checking against the site’s fail-proof online value creation calculators.

Detailed Examples

No more guesswork due to step-by-step examples, clearly defined variables and equations, and links to proofs and further reading.

Who are ValueBridge.net subscribers?

Private equity practitioners, who need robust and reliable value creation models, today!

General Partners

DIFFERENTIATE!

Raise more capital by telling better stories

Use data to show how your investment approach and value creation strategies drive returns.

Limited Partners

VALIDATE!

Make sure narratives are supported by numbers

Measure if GP initiatives materially impact portfolio company capital structures, P&Ls, and valuations.

Industry Researchers

CALCULATE!

Expand the universe of analyzable companies

Models rely on practical and accessible inputs that allow a larger number of companies to be analyzed.

HURRY! OFFER EXPIRES ON MARCH 31, 2024!

Frequently Asked Questions (FAQs)

What is included in a ValueBridge.net subscription?

Active subscribers have access to 100% of available ValueBridge.net content, including video instruction, Excel templates, online calculators, module notes, references, case studies, community forums, and support.

Video

Instruction

Excel

Templates

Online

Calculators

Detailed

Examples

References

Case

Studies

Forums

Support

What content is currently available?

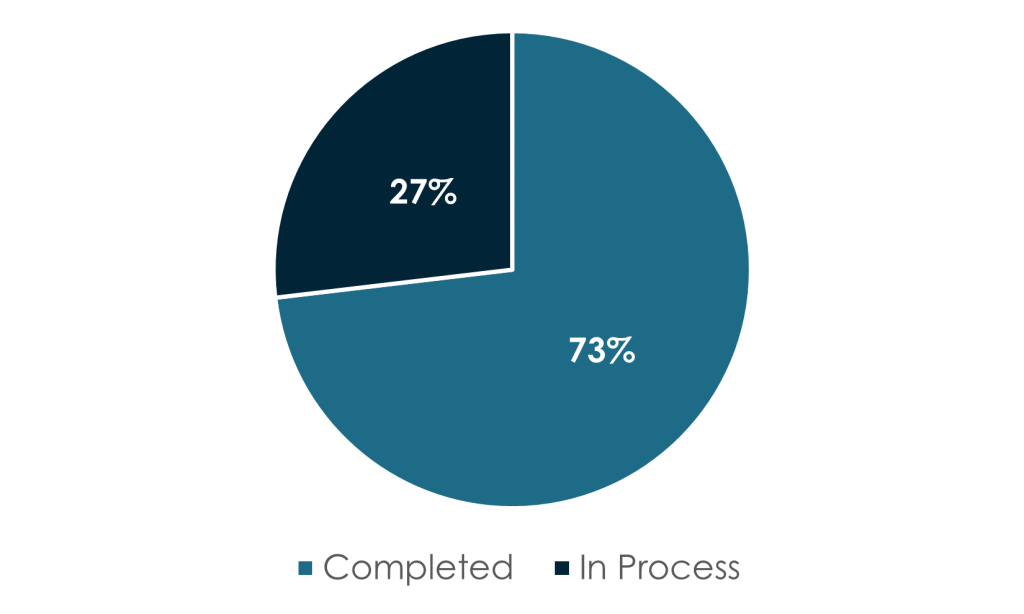

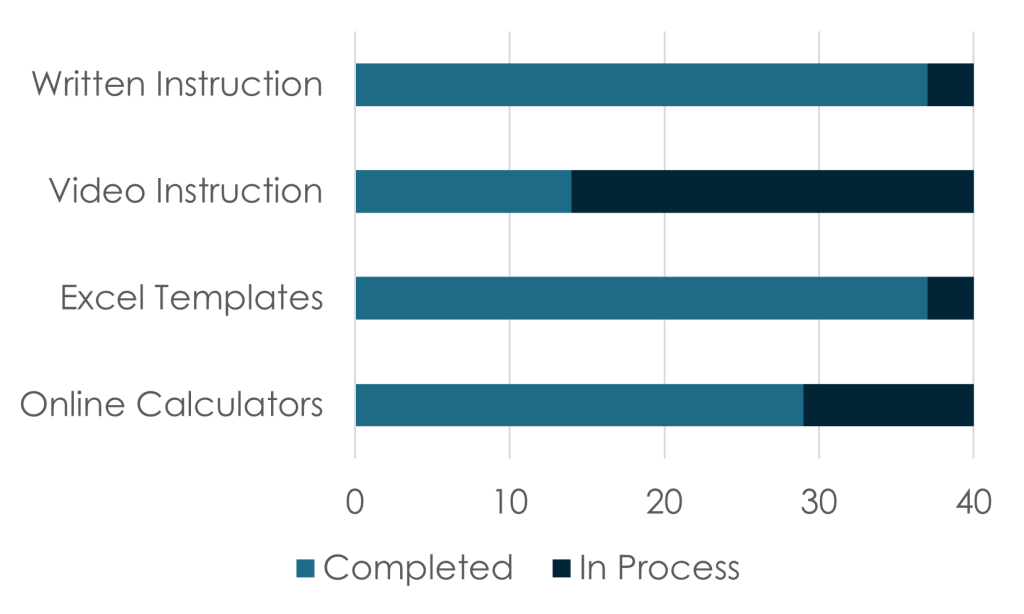

Over 70% of ValueBridge.net content is already complete. Nearly all of the Microsoft Excel Templates are available and written instruction, with step-by-step examples, has been provided for more than 90% of the first 40 ValueBridge.net Modules. Video instruction is available for all the major value drivers related to investment performance, capital structures, and broader market forces. Additional content is being added every month.

Total Content Status

Module Component Status

Module Component Details

When will all ValueBridge.net content be completed?

The first 40 ValueBridge.net modules will be completed before year-end 2023. New content is being added every week.

How do the Excel templates work?

This ~5 minute video shows how you can use the ValueBridge.net Excel templates to kick start your own value creation models.

The video briefly covers:

- Finding an applicable Module

- Choosing the right Tab for the appropriate valuation-basis

- The two value creation models

- The five value creation measurements

- Modifying the value bridge chart

- Adapting template for financing activities

How do the Online Calculators work?

The Online Calculators are an important part of the ValueBridge.net toolkit. They perform the same math as the Excel templates, but they cannot be altered (broken) through human error. Consider using the Online Calculators to occasionally spot-check your Excel models. Certainly do so before significant events, like including results in a Private Placement Memorandum or an Investment Committee Memo.

To check your work, start with a similar ValueBridge.net Module and select the appropriate parameters. Copy only the “independent variables” from the Excel file to the Online Calculator. This saves time because the Excel model’s 60-80 numbers are mostly dependent variables, but only the 8-10 independent variables must be plugged into the Online Calculator. Choose either the Derivative Model or Logarithmic Model from the drop-down to view results.

Make sure that Excel model and Online Calculator provide the same answers. If there is any discrepancy greater than 1-2%, start working backwards through the Online Calculator’s calculated dependent variables to find the source of the error. Consider using the “PRINT” button to make a hard copy and “check-off” the correct variables as you search for the wrong ones.

What are the ValueBridge.net Case Studies?

Case Studies highlight interesting applications of ValueBridge.net mathematics, as well as other platform features. Some content has already been created, but this section will become more interesting after the first 40 ValueBridge.net Modules are entirely complete.

Non-subscribers can view some of the Case Study content, but active subscriptions are required to comment or download related Excel templates.

What is the ValueBridge.net Forum?

The Forum section currently highlights updates that are being made to the site. Subscribers can access all forum content, create topics ask questions, and post replies, so this section may become more interesting as subscribers join the site.

How can I get support regarding ValueBridge.net topics or templates?

Subscribers can send an email or schedule a call on the ValueBridge.net Support page.

Who runs ValueBridge.net?

Mike Reinard has been working with private equity GPs and institutional LPs for over 15 years. He helps fund managers tackle resource intensive financial analysis, marketing, fundraising, and investor relations projects (e.g., creating complex portfolio analyses, writing the next private placement memorandum, or building a custom direct deal sourcing software application, etc.).

Mike specializes in the mathematics of private equity. He wrote the book Private Equity Value Creation Analysis in 2020 and also runs the private equity mathematics website AUXILIA Mathematica.

What is “Private Equity Value Creation Analysis”?

Published in 2020, Private Equity Value Creation Analysis is a top private equity book on Amazon.com. It is a comprehensive handbook for the analysis of private companies and portfolios. Its framework quantifies how leverage, valuation, company P&Ls, market and industry trends, and other factors drive equity returns. Such analyses are used by private equity and venture capital fund managers to explain their approaches to buying and selling companies and by institutional investors to validate them.

Specifically designed for the particularities of private equity ownership, the book’s value creation models are mathematically rigorous and based on metrics that are practical and accessible (i.e., those generally found in fund manager reporting and marketing materials). Formulas are built to function over the widest range of company, industry, and market conditions and provide intuitive and non-volatile results.

What is AUXILIA Mathematica?

AUXILIA Mathematica was started as a private equity math blog in 2019. The articles, Excel templates, and online calculators initially posted there led to a rigorous mathematical framework that formed the basis of the book Private Equity Value Creation Analysis, published at the end of 2020.

Since 2021, AUXILIA Mathematica has been exploring and explaining the mathematics of private equity through video, on the site and AUXILIA Mathematica’s YouTube page. These videos describe the math in the book and additional applications, with a focus on proofs, derivations, and direct comparisons with other models used in academic and industry research.

How are ValueBridge.net and AUXILIA Mathematica different?

ValueBridge.net is application-focused and subscription-based. Each of the 40 ValueBridge.net modules includes downloadable Excel templates, short video demonstrations, step-by-step examples, and online value creation calculators that test models for errors.

AUXILIA Mathematica is theory-focused and free with registration. Content often includes detailed proofs, derivations, and direct comparisons with other models used in academic and industry research. Excel templates and online value creation calculators are available for some (not all) topics on the site.

ValueBridge.net is designed for private equity analyst who want immediate results and generally lack the time or inclination to read a 240-page math book or spend five hours watching video on the AUXILIA Mathematica YouTube page.

How much does a ValueBridge.net subscription cost?

Sign up before March 31, 2024 to save 33% on Analyst Edition pricing below:

- $25.00 USD per month, billed monthly

- $20.00 USD per month, billed quarterly ($60 USD per quarter)

- $15.00 USD per month, billed annually ($180 USD per year)

HURRY! OFFER EXPIRES ON MARCH 31, 2024!

Will my subscription auto-renew?

Yes. Your subscription will renew either monthly, quarterly, or annually, depending upon options chosen at sign-up. You can manage payment methods or cancel the subscription on your Account page.

Can I cancel my subscription?

Yes, you can do so with one click on your Account page.