This new crash course helps buyout, growth, and venture funds optimize and use portfolio company performance metrics to illustrate investment and operational skills and tell more interesting and credible stories about how they create value in private equity deals.

The Decoding Value Creation workshop starts with an interactive online presentation to your investor relations or reporting teams. It usually lasts about 60-minutes with Q&A. After the presentation, participants can schedule up to two hours of follow-up consultation to help optimize or trouble shoot your own value creation models.

Workshop participants receive immediate access to the presentation deck, a Microsoft Excel template that demonstrates all models and mathematics, and a pre-recorded version of the presentation that may be previewed in advance or reviewed after the scheduled workshop.

Additionally, up to three workshop participants receive one year of full-access to ValueBridge.net content (valued at $540 USD). Access 100+ Microsoft Excel templates that are custom-built for dozens of private equity buyout and growth equity scenarios and supported by step-by-step written instructions, video demonstrations, and online error-checking tools.

Decoding Value Creation Topics

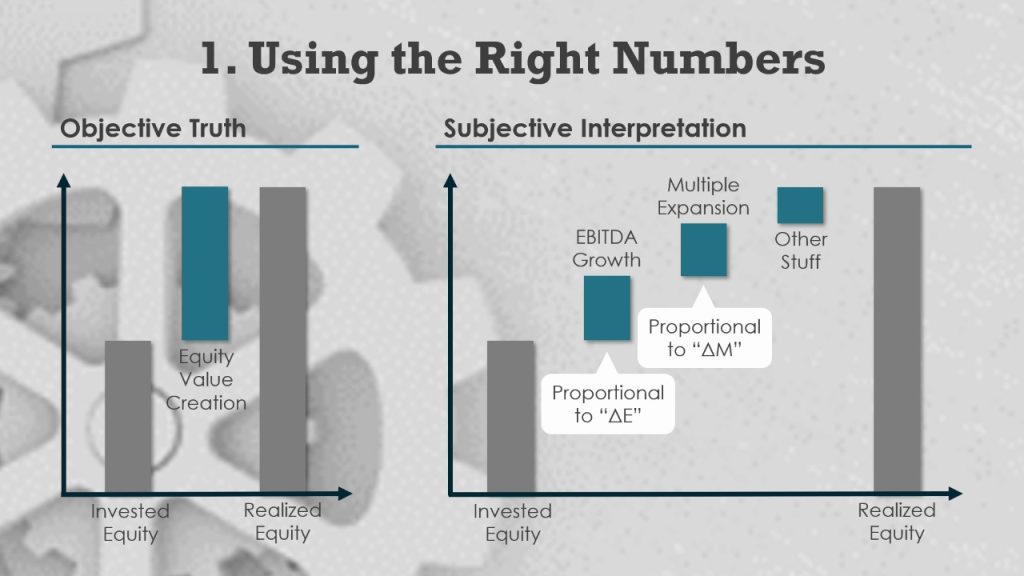

Using the Right Numbers

Maximize your apparent skill as an investor and operator by sending the right portfolio company financial metrics to prospective Limited Partners.

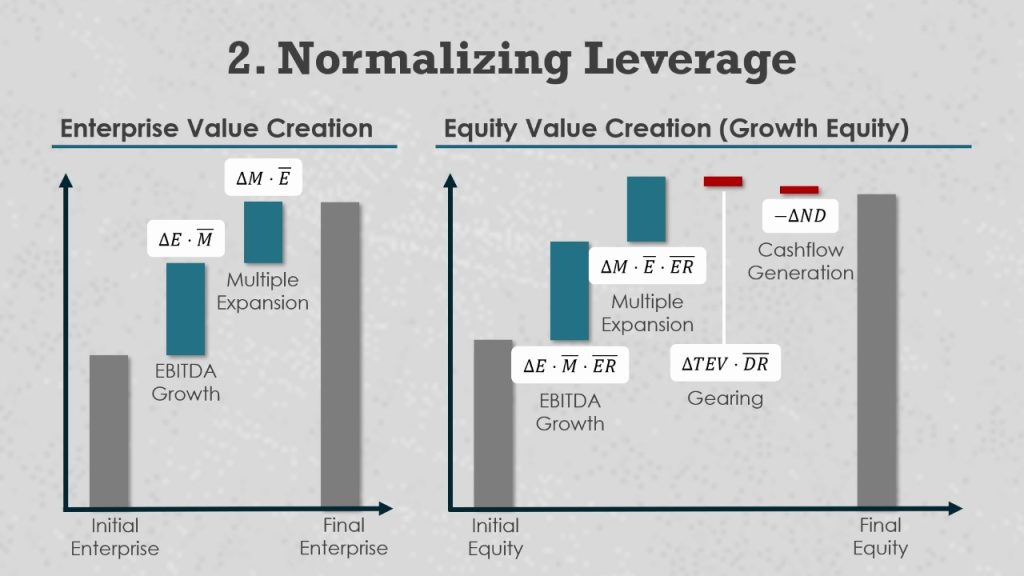

Normalizing Leverage

Precisely quantify gains or losses from amplifying equity returns with debt, de-levering capital structures, and using equity to fund growth initiatives.

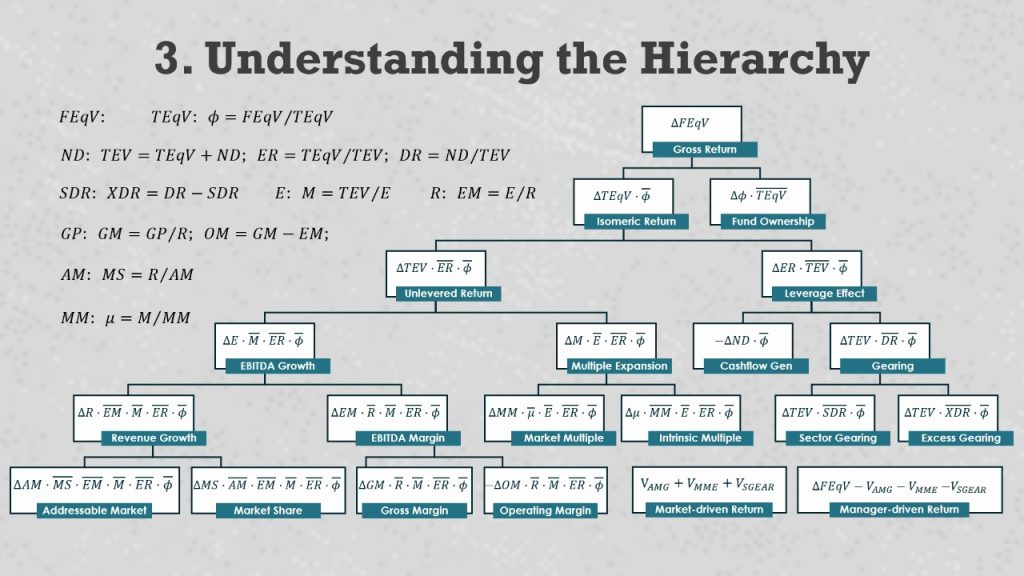

Understanding the Hierarchy

Design robust value creation models that reliably measure how equity returns come from movements in underlying portfolio company financials and broader market metrics.

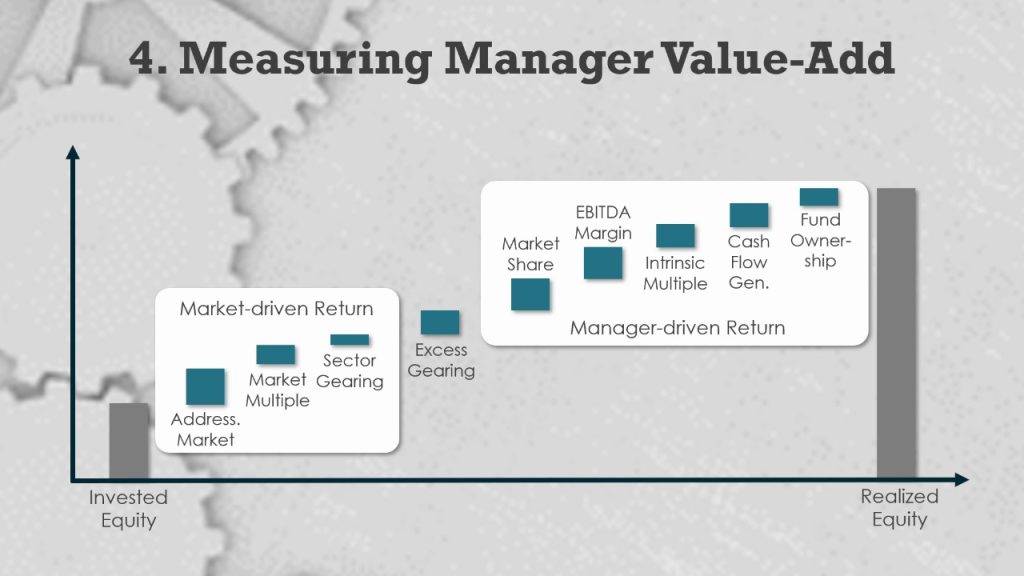

Measuring Manger Value-Add

Calculate equity returns driven by improving market share, EBITDA margins, quality of revenue or earnings, and cash management, as well as equity structuring mechanics.

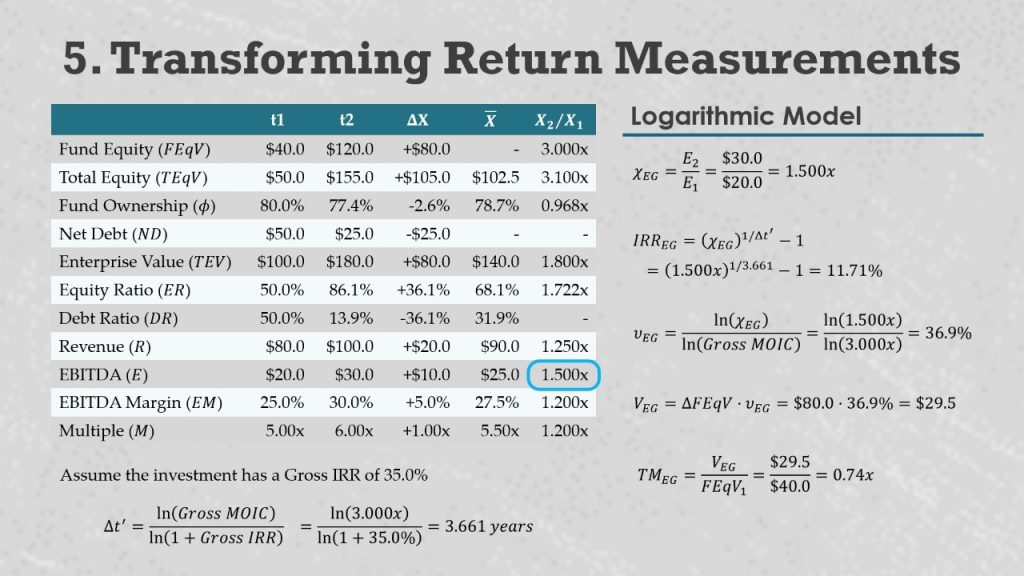

Transforming Return Measurements

Convert any absolute ($) value driver into capital- or time-dependent measurements like times money value creation, equity return multipliers, or value creation IRRs.

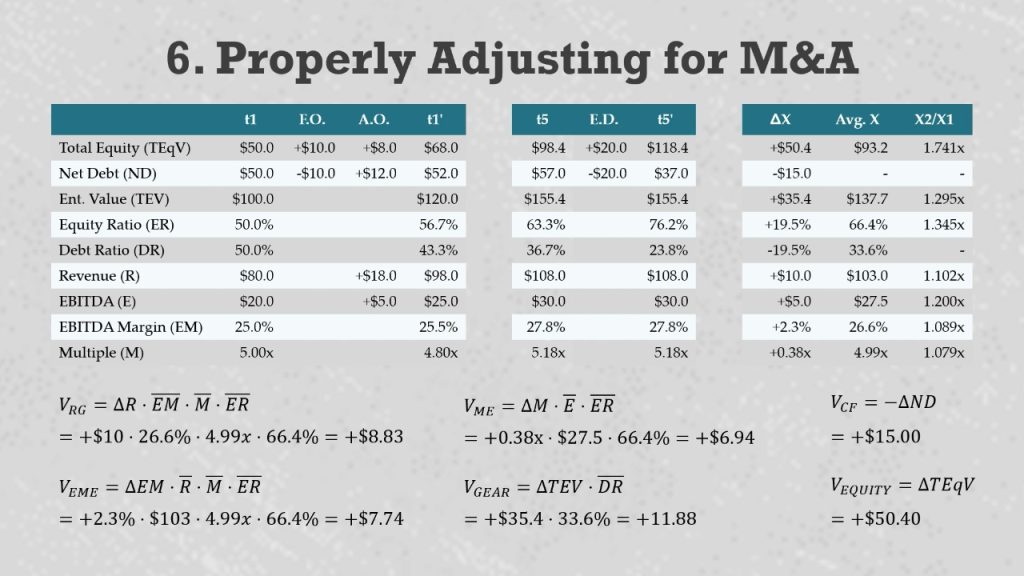

Properly Adjusting for M&A

Incorporate add-on acquisitions, asset sales and purchases, support equity investments, dividend recapitalizations, and other financing and M&A activities into value creation models.

Start Decoding Value Creation Today!

Sorry, it appears that you do not have access to the Decoding Value Creation workshop content below. Please try purchasing this workshop, signing in, or contacting support.