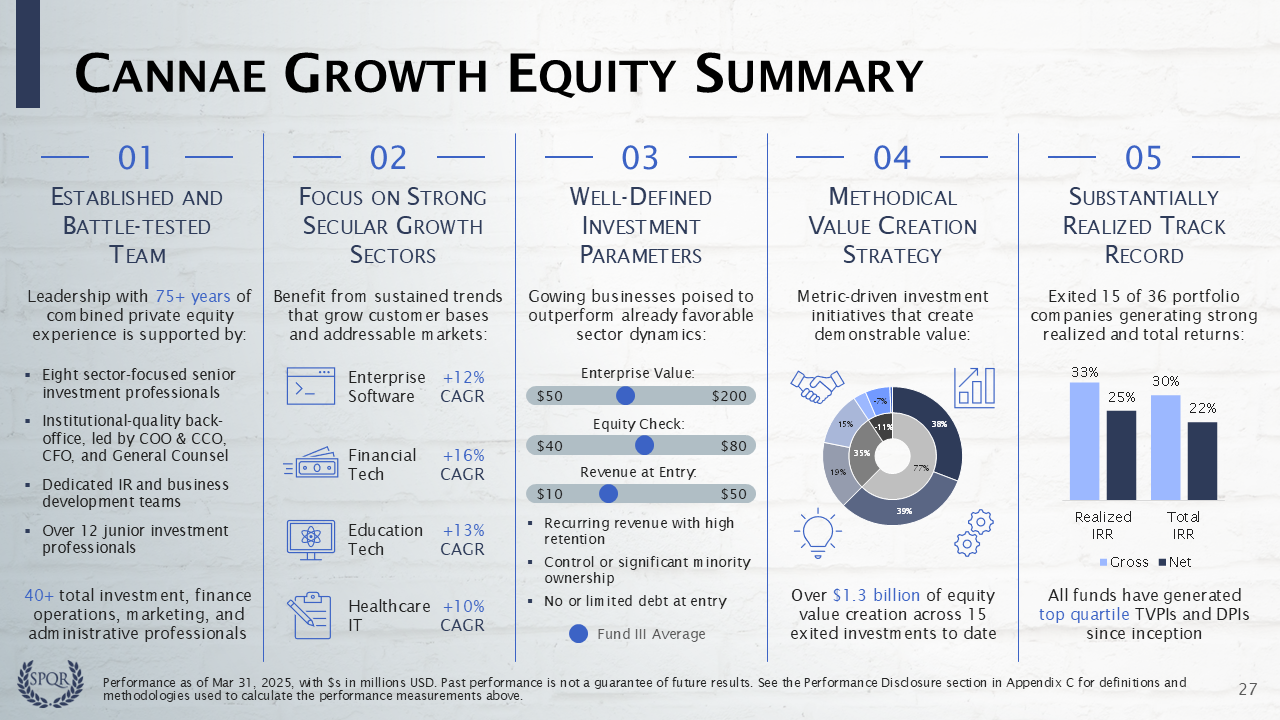

Part 1 – Overview of a growth equity fundraising deck that uses fund and portfolio company performance metrics to illustrate key elements of the GP’s investment and value creation strategy. The first few slides cover the firm and team.

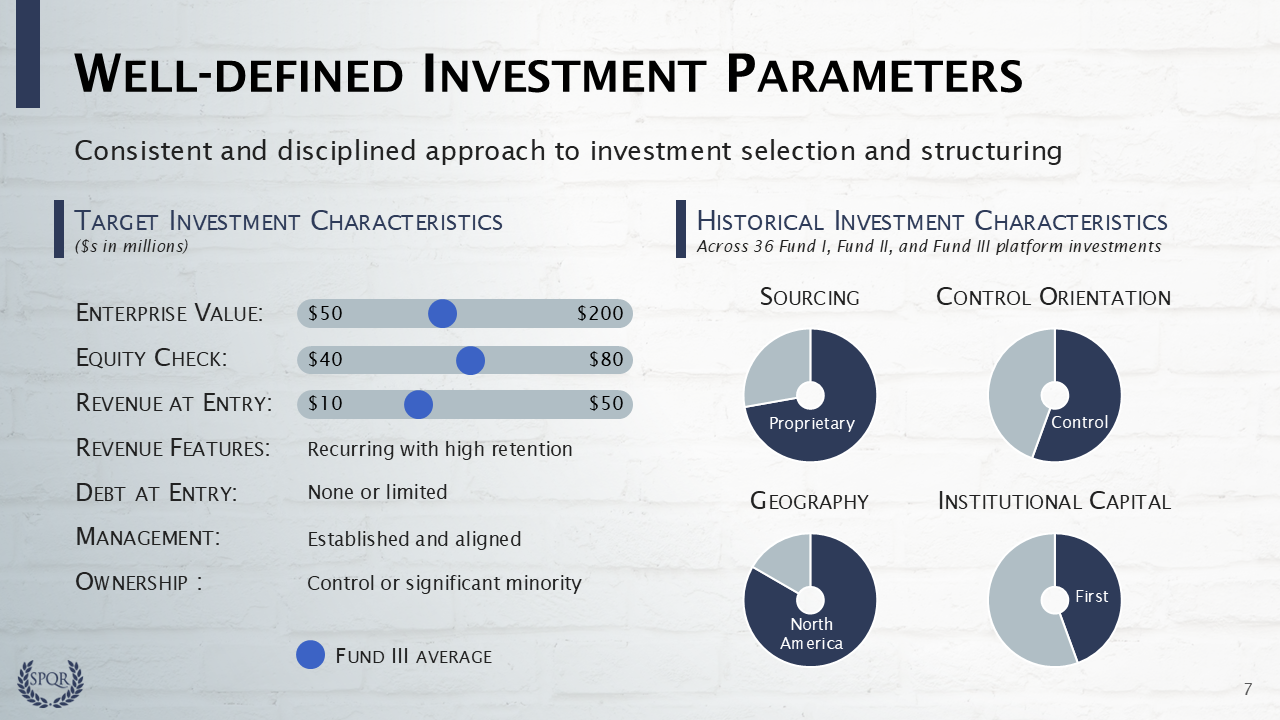

Part 2 – Overview of a growth equity fundraising deck. The next three slides cover the Fund’s investment strategy, investment characteristics, and origination process.

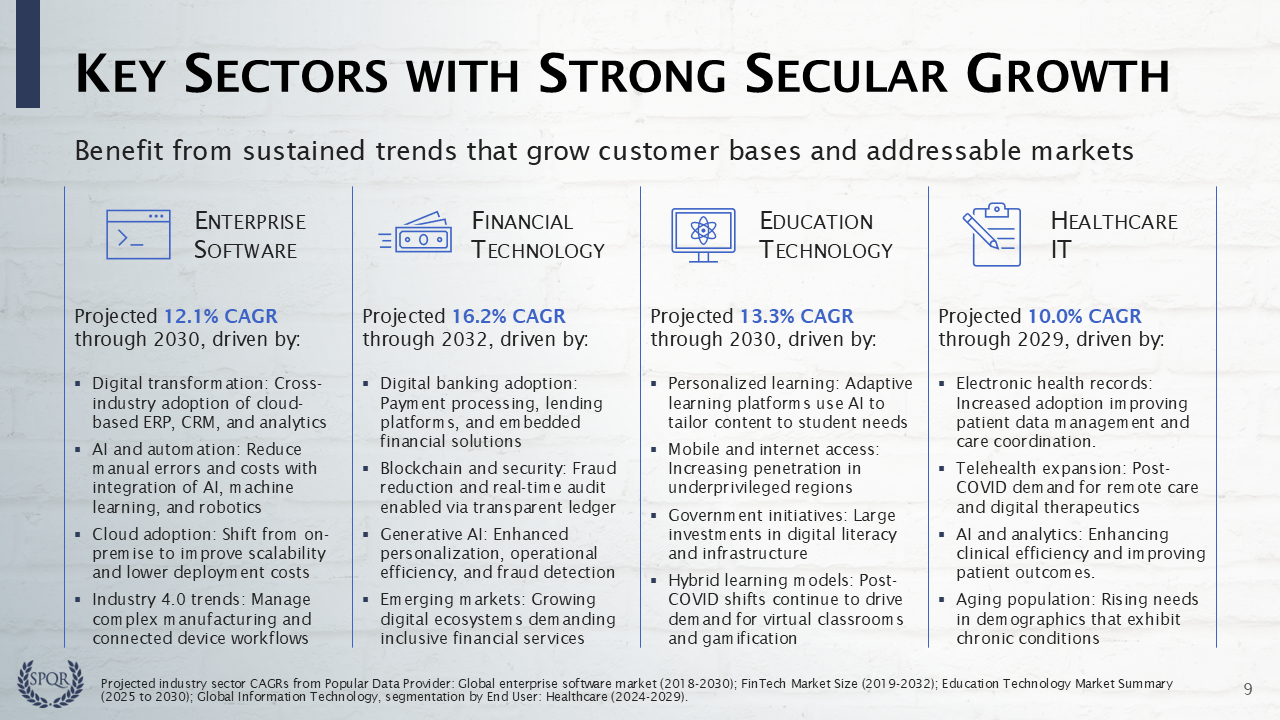

Part 3 – Overview of a growth equity fundraising deck. Three market overview slides cover the Fund’s target investment sectors, as well as portfolio companies, capital deployment, and returns in each sector.

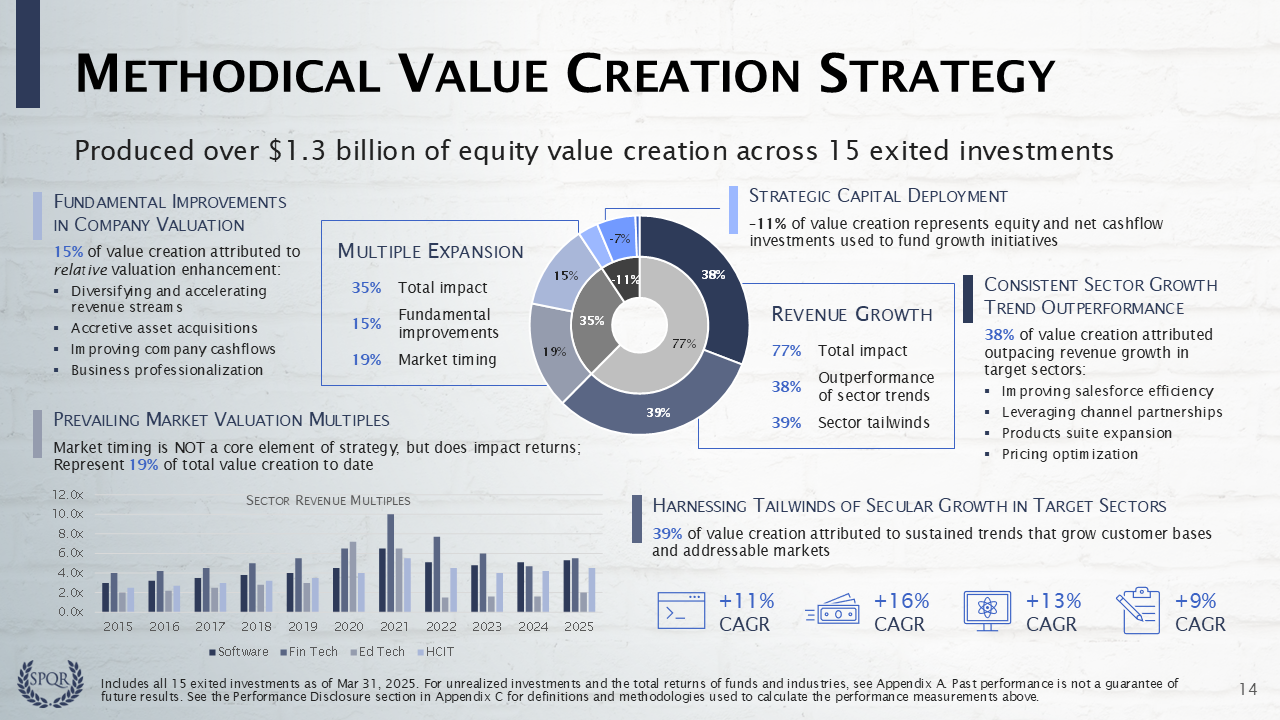

Part 4 – Overview of a growth equity fundraising deck. Four value creation slides cover strategy, the return drivers in 15 exited portfolio companies, and efforts to maximize transaction values at exit.

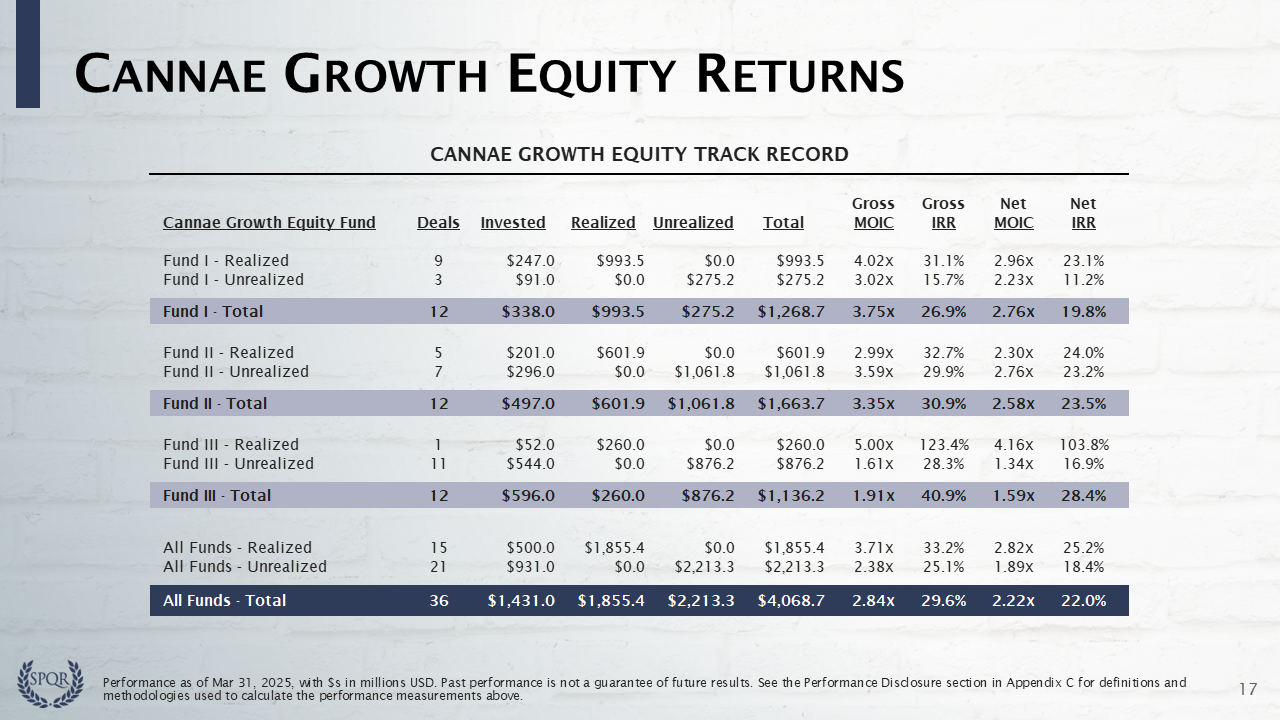

Part 5 – Overview of a growth equity fundraising deck. Three track record slides cover gross and net returns for funds, sectors, and individual deals, as well as TVPI and DPI comparisons to median and top-quartile benchmarks.

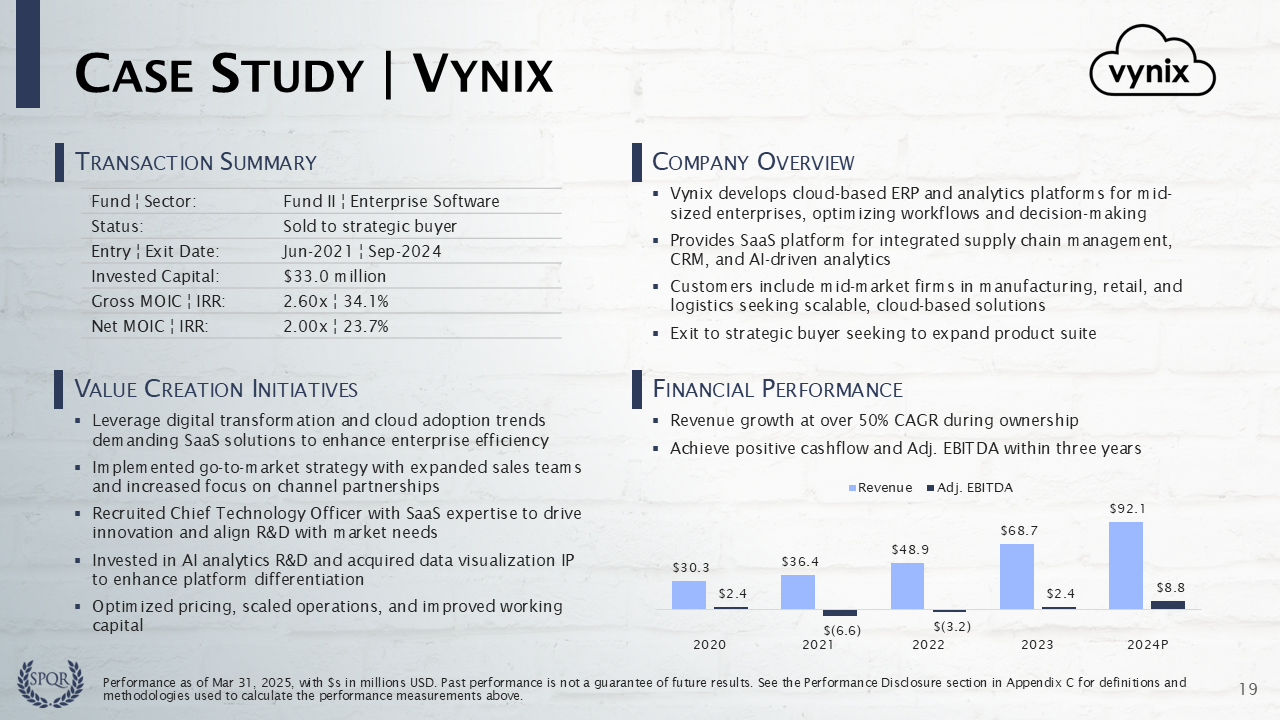

Part 6 – Overview of a growth equity fundraising deck. Eight slides cover four portfolio company case studies. We focus on key value creation initiatives driving ROI.

Part 7 – Overview of a growth equity fundraising deck. Three conclusion slides provide a presentation summary, principal terms, and contact details.

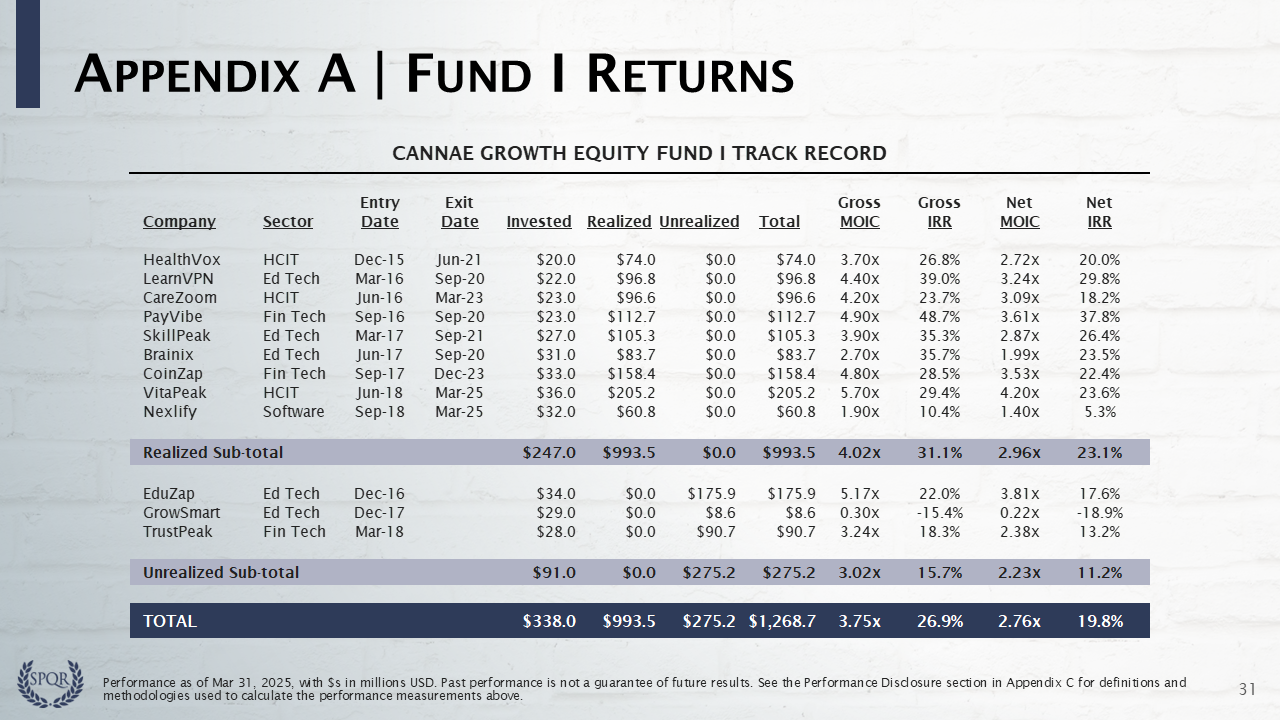

Part 8 – Overview of a growth equity fundraising deck. Seven track record detail slides in Appendix A cover gross and net returns for each fund, sector, and portfolio company.

Part 9 – Overview of a growth equity fundraising deck. Eight slides in Appendix B provide team biographies for 16 investment, operations, and marketing professionals.

Part 10 – Overview of a growth equity fundraising deck. The last section explores some of the performance disclosures that are required to satisfy legal and regulatory requirements.