ValueBridge.net features tools that help analysts measure value creation in private equity deals and create compelling marketing content for fundraising pitchbooks, PPMs, and DDQs. Measure how returns are driven by changes in portfolio company P&Ls, capital structures, and broader market conditions. Use the models to demonstrate the differentiation of an investment or value creation strategy.

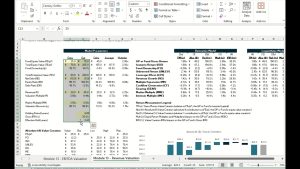

Modules: Structured like an online course, each of the 40 modules features downloadable Microsoft Excel templates, short video demonstrations, step-by-step examples, and online calculators that test models for errors. Subscribers can build confidently – and save time – by leveraging private equity value creation models that are already optimized for numerous applications.

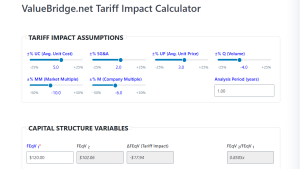

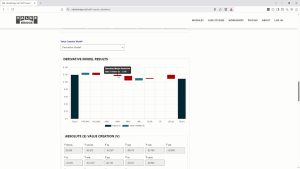

Case Studies: Examples of the ValueBridge.net models solving real-world problems. The latest features include quick corrections that can fix broken value bridges, cross-border deals that require foreign exchange rate adjustments, quantifying the impact various ESG initiatives, value creation in buy-and-build or roll-up strategies, and the impact of tariffs.

Pitchbooks: Learn how to build private equity fundraising pitchbooks from scratch, or just generate a few new ideas for your next annual meeting presentation or PPM. The series features a fundraising deck for a hypothetical growth equity fund. The design illustrates key elements of a GP’s investment and value creation strategy using the ValueBridge.net models.

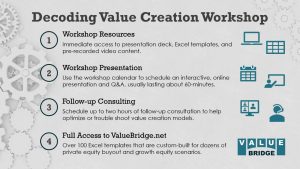

Additional Features: Subscribers can use the Support page to schedule a call or receive email support for ValueBridge.net topics or templates. They may also ask questions on the ValueBridge.net Forum. If you need to put your team through track record or value creation boot camp, consider scheduling one of the ValueBridge.net Workshops. Several demonstrations of ValueBridge.net features are provided below: