This is Part 7 of a series that walks through a growth equity fundraising deck. Three conclusion slides wrap up the main presentation body, with a one-slide snapshot of team, investment and value creation strategy, and returns, followed by a summary of principal fund terms and a contact slide.

All the presentation data, analyses, and charts are available in the Microsoft Excel and PowerPoint files below:

If you need help or additional bandwidth for private equity marketing or track record projects like this, get in touch with me through the support page or my consulting website.

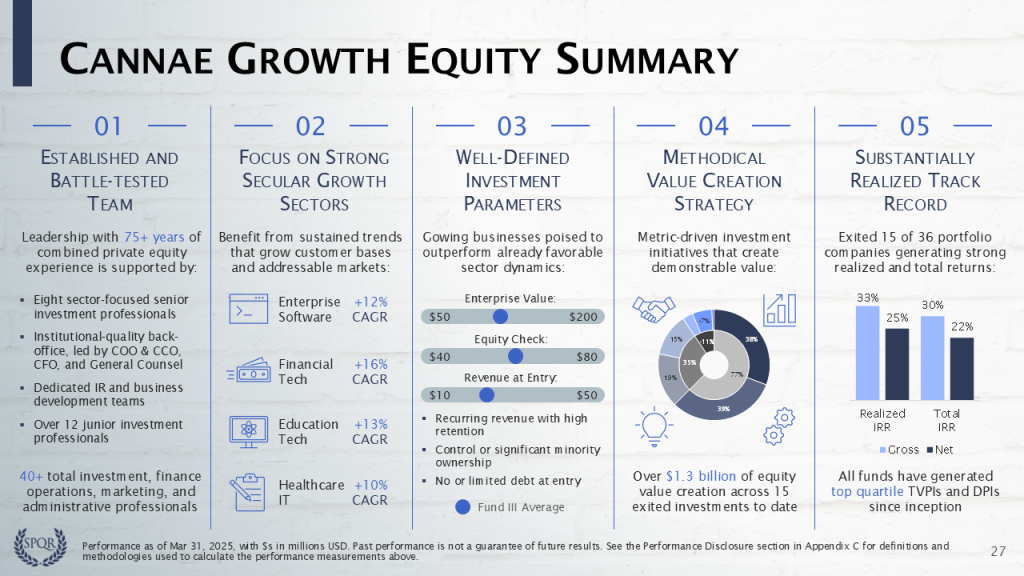

Firm Summary

First, in the Introduction, you told audiences what you were going to say. Then, in the next five sections, you said it. Now, in the conclusion, you should tell them what you said. The Firm Summary slide endeavors to follow this sage advice from Aristotle, or Dale Carnegie, or whoever actually said it…

The conclusion should highlight and reinforce the most credible and compelling aspects of the story. Our slide is busy with data, but all the content should have been already covered in detail. We simply wish to remind audiences of a few key points before wrapping up the presentation:

01 Established and Battle-tested Team shows that the three managing partners have substantial, relevant investment experience, assembled a strong, sector-focused investment team, and built an institutional quality platform with 40+ investment, finance, operations, and marketing professionals.

02 Focus on Strong Secular Growth Sectors illustrates the impressive CAGRs in each target sector, which have generated significant equity value in the portfolio to date (see the Value Creation and Case Study slides) and should continue to drive value over the life of Fund IV.

03 Well-defined Investment Parameters reiterates Fund IV’s target investment characteristics and shows that they are consistent with prior funds, so there is no size or strategy drift.

04 Methodical Value Creation Strategy reminds audiences of the firm’s metric-driven investment and value creation initiatives that have already generated over $1.3 billion of capital gains in the first 15 exited investments to date.

05 Substantially Realized Track Record demonstrates the impressive Gross and Net IRRs for the 15 exited portfolio companies, as well as the entire 36 investment portfolio. To date, all three funds have generated top-quartile TVPIs and DPIs.

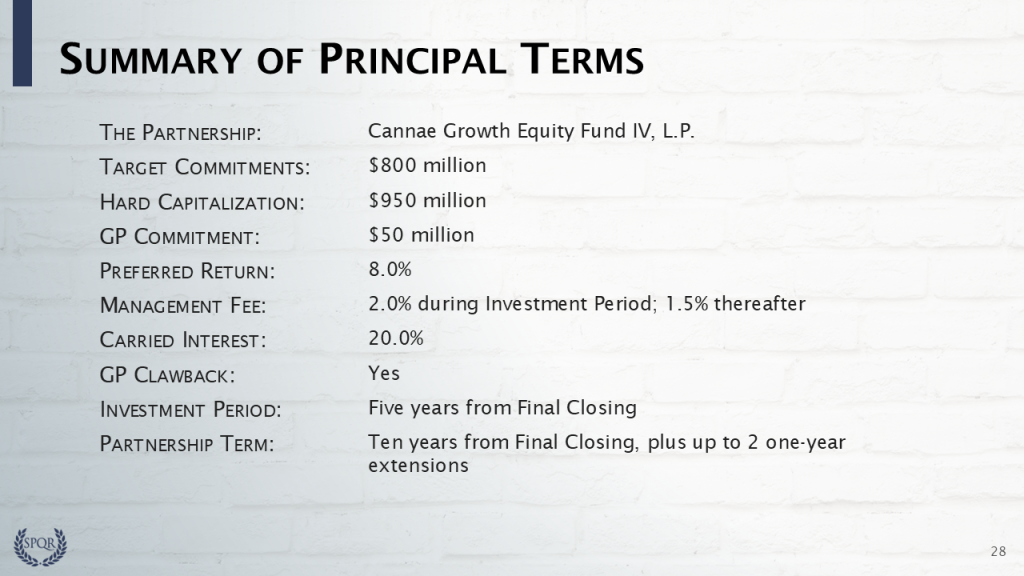

Fund Terms

A firm that is actively fundraising should have a summary of principal fund terms in the conclusion section. If the target size is consistent with prior funds and the terms are market, you probably will not spend much time on this slide. If not, however, expect lengthier discussions…

Please log in access additional content. Not a subscriber? Sign-up today!.