This is Part 8 of a series that walks through a growth equity fundraising deck. The next seven slides include track record details that cover gross and net returns for each fund, sector, and portfolio company.

All the presentation data, analyses, and charts are available in the Microsoft Excel and PowerPoint files below:

If you need help or additional bandwidth for private equity marketing or track record projects like this, get in touch with me through the support page or my consulting website.

Fund Track Record Details

Throughout the presentation we highlighted returns for various segments of the portfolio:

- Gross and Net MOICs and IRRs for the 15 exits in the Introduction

- Total portfolio Gross and Net IRRs for each of the target sectors in the Market Overview

- All three funds and the realized and unrealized investment cohorts within them in the main Track Record section

- Select individual portfolio company returns in the Case Studies

- Gross and Net IRRs for the 15 exits and total portfolio in the Conclusion

Except for total portfolio performance for the three funds, everything else is “Extracted Performance” according to the SEC’s Marketing Rule 206(4)-1. Therefore, to satisfy the rule, we must also present total portfolio gross and net performance in a manner designed to facilitate comparisons with Extracted Performance.

However, showing audiences detailed return tables too early in a presentation tends to invite digressions that disrupt the intended conversation flow. Placing these track record details in an appendix can help to keep the presenters on message. More importantly, this provides sufficient space to adequately back-up every performance statement and disclose returns for other funds and portfolio companies.

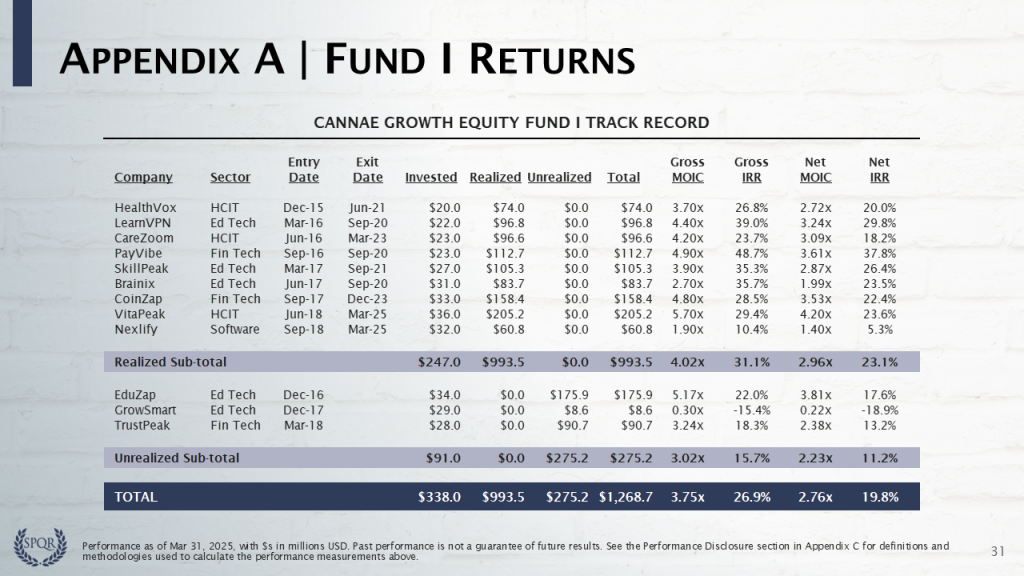

Fund I Returns

For example, here are the track record details for Fund I. The highlighted performance lines — TOTAL and Realized and Unrealized subtotals — back-up the figures reported in the main Track Record section (slide 17). Since slide 16 and the Case Studies highlight returns for some Fund I portfolio companies, this table is necessary to disclose the returns for the rest of them.

Note that the only “real” net returns on this table are in the bottom TOTAL line. Management fees, fund expenses, and carried interest are pooled across every fund investment, so net returns for individual investments or the Realized and Unrealized cohorts are always theoretical, model-driven estimates.

Over the last five years, more GPs have been adding “estimated” net returns to presentations due to ambiguity about the SEC’s requirement to always present gross and net returns together, with equal prominence. However, the SEC provided additional guidance through its Marketing Compliance Frequently Asked Questions on March 19, 2025, suggesting that estimated net return models for certain extracted subsets may not be necessary.

Make sure to speak with fund formation counsel and compliance consultants before striking estimated Net MOIC and Net IRRs from your deck. We decided to keep them in the presentation, because (1) they may still be needed for certain situations and (2) our methodology is efficient and requires little extra spreadsheet work. Download one of the Excel templates to see the model in action and learn about the methodology in Module 01 or in the Net Return series at auxiliamath.com.

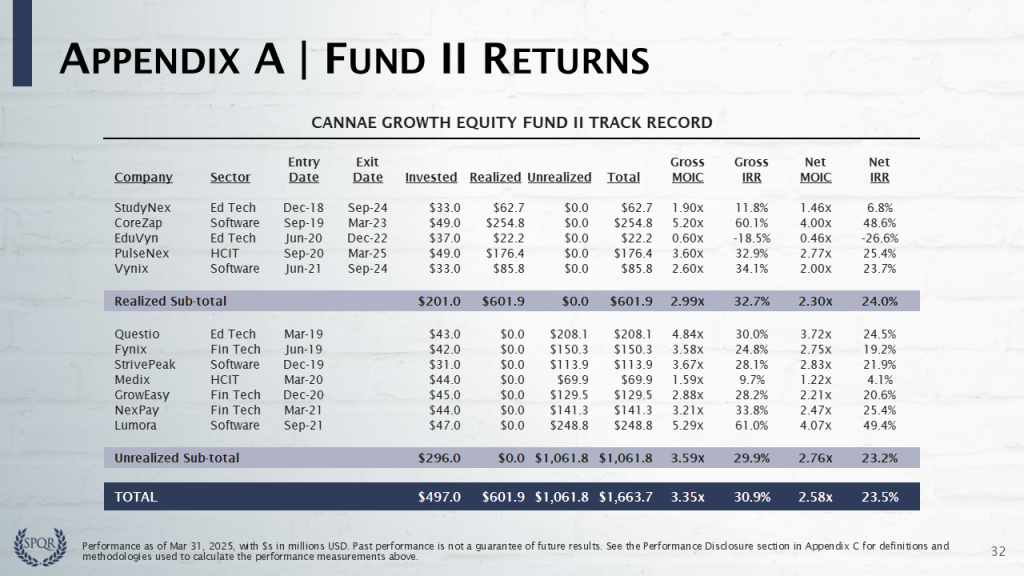

Fund II Returns

Below are the track record details for Fund II. The highlighted performance lines — TOTAL and Realized and Unrealized subtotals — back-up the figures reported in the main Track Record section (slide 17). Since slide 16 and the Case Studies highlight returns for some Fund II portfolio companies, this table is necessary to disclose the returns for the rest of them.

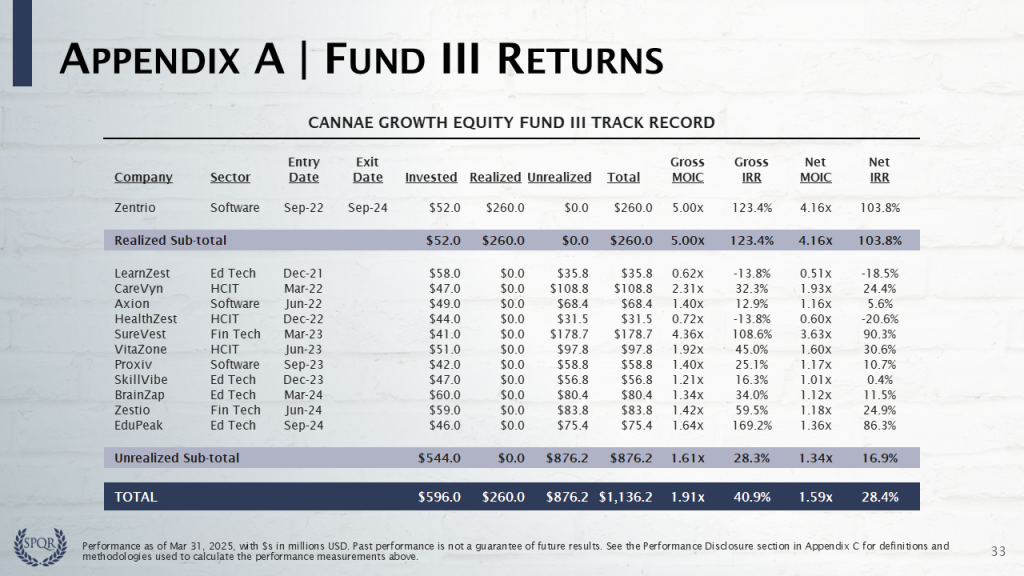

Fund III Returns

Below are the track record details for Fund III. The highlighted performance lines — TOTAL and Realized and Unrealized subtotals — back-up the figures reported in the main Track Record section (slide 17). Since slide 16 highlights returns for just one Fund III portfolio company, this table is necessary to disclose returns for the other eleven.

Please log in access additional content. Not a subscriber? Sign-up today!.