This series walks through a fundraising deck that I created for a hypothetical growth equity fund. The design illustrates key elements of a GP’s investment and value creation strategy using our value creation models. Hopefully it generates a few ideas for your next pitchbook or annual meeting presentation.

All the presentation data, analyses, and charts are available in the Microsoft Excel and PowerPoint files below:

If you need help or additional bandwidth for private equity marketing or track record projects like this, get in touch with me through the support page or my consulting website.

Cannae Growth Equity Fund IV, L.P.

This is an entirely fabricated presentation that, to the best of my knowledge, bears no resemblance to any real firms or funds. Those who would brand a firm with Roman iconography are unlikely to name it after the crushing defeat delivered by Hannibal in 216 BCE.

Disclosures

Every fundraising deck requires at least one Disclosure slide. Check with fund formation counsel and compliance consultants for the latest language appropriate to your size and strategy.

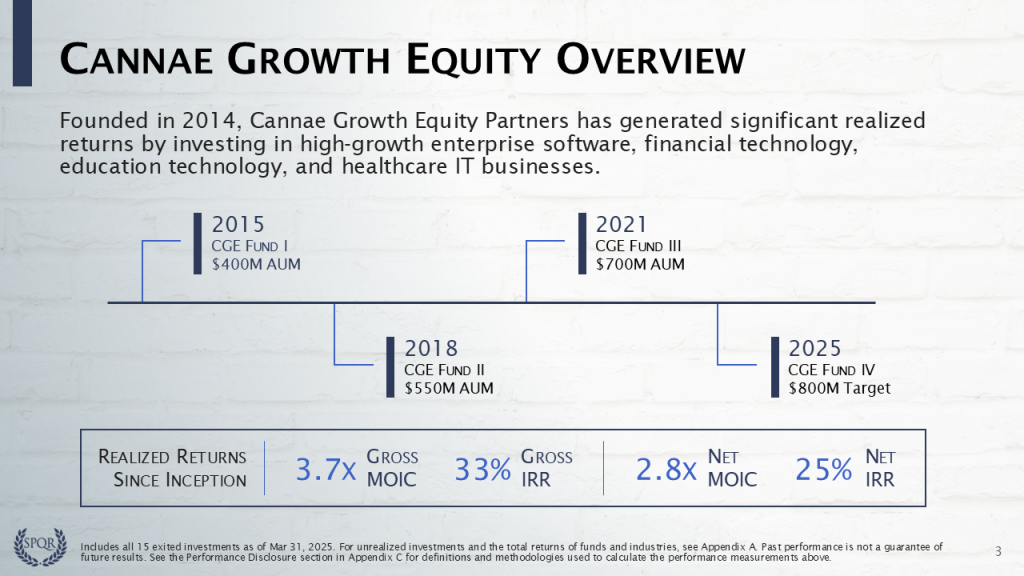

Firm Overview

The first content slide is typically a Firm Overview that serves as a backdrop for the first 2-3 minutes of discussion. It illustrates key elements like the firm’s history, size, and investment focus, so audiences can fit the fund into their mental allocation framework.

Formats for this slide are quite diverse and depend upon a firm’s size and maturity:

- Large, established firms tend to emphasize their global presence and hundreds of billions in AUM

- New firms without established track records often lead with team or the hot sector in which the fund will invest

- Others typically highlight 4-6 key pitch elements and set up themes to revisit later in the presentation

Introduction to Cannae Growth Equity

For this fundraising deck, we chose to highlight that the firm:

- Should have significant runway at only 10-years old, but is no longer an “emerging manager”

- Is a growth equity stage investor, focused on four key sectors

- Manages over $1.6 billion of committed capital across three funds

- Is raising a reasonably sized Fund IV, on a timeline consistent with past deployment

- And has achieved excellent realized returns since inception

A Foretaste of Portfolio Performance

I recommend including a performance statement on this first slide. It is too early to discuss track record in any detail, but you can foreshadow that conversation and remind audiences why it will be worth attending to the slides that precede it.

You generally have some flexibility in choice of performance metric, as long as it is adequately disclosed. The “realized returns” above reflect the combined performance of 15 exits in three funds. Firms with longer histories sometimes highlight the individual or aggregate returns for just their most recent 2-4 funds.

The SEC’s Marketing Rule 206(4)-1 defines these subsets as “Extracted Performance”. It is important to emphasize that these are only subsets of total performance, which should available elsewhere in the fundraising deck (for example, see the footnote, slide 17, and Appendix A).

Since the 15 exits do not comprise a dedicated fund with its own management fees, expenses, and carried interest, presenting Net MOIC and Net IRR requires a hypothetical model. Download one of the Excel templates for our net return model and learn about the methodology in Module 01 or in the Net Return series at auxiliamath.com.

The performance footnote at the bottom is probably shorter than what fund formation counsel and compliance consultants would recommend. However, consider starting with shorter footnotes because they tend to get longer with every legal and compliance review.

One more point… before choosing the headline performance metric, think through how it may change over the next 12 to 18 months. It is never good to have a key number drop during the fundraise. If an investment subset is small, then moving one or two companies from active to exited can change performance significantly — especially if it is an IRR.

What follows Firm Overview?

This depends on how you wish to structure the discussion. Based on my review of 50+ fundraising decks, there are several appropriate options, including: target markets or sectors, investment strategy, operating or value creation framework, team, detailed track record, purpose or mission statement, and more. We chose to follow with team.

To determine the best order for your fund, consider establishing a script or “talk-track” that is independent of the pitchbook. First, identify the most important details to communicate. Then, arrange those facts into the order that makes the most convincing or compelling narrative. This is often the best order for presentation content.

Instead of creating a fundraising deck and then determining what you will say on each slide, build it around the best talk track — consider the deck to be a visual aid that makes the conversation more credible and more interesting.

Of course, audiences will ask questions that change the discussion flow. Partners will go off on tangents about technical diligence before they realize that eyes are glazing over. The odds that your presentation gets “derailed” increase every minute. So, try to cover important or difficult topics earlier, in the more scripted sections, rather than later when discussions become more organic and free-wheeling.

Please log in access additional content. Not a subscriber? Sign-up today!.

Comments are closed.