Analyst Edition

From: $25.00 / month

Full access to video instruction, Excel templates, online calculators, notes & references, case studies, community forums, and support.

Description

Full access to available video instruction, Excel templates, online calculators, module notes, references, case studies, community forums, and support.

Click here for the current status of ValueBridge.net content.

ValueBridge.net Modules:

- Net MOIC and Net IRR

- Equity Dilution and Equity Concentration

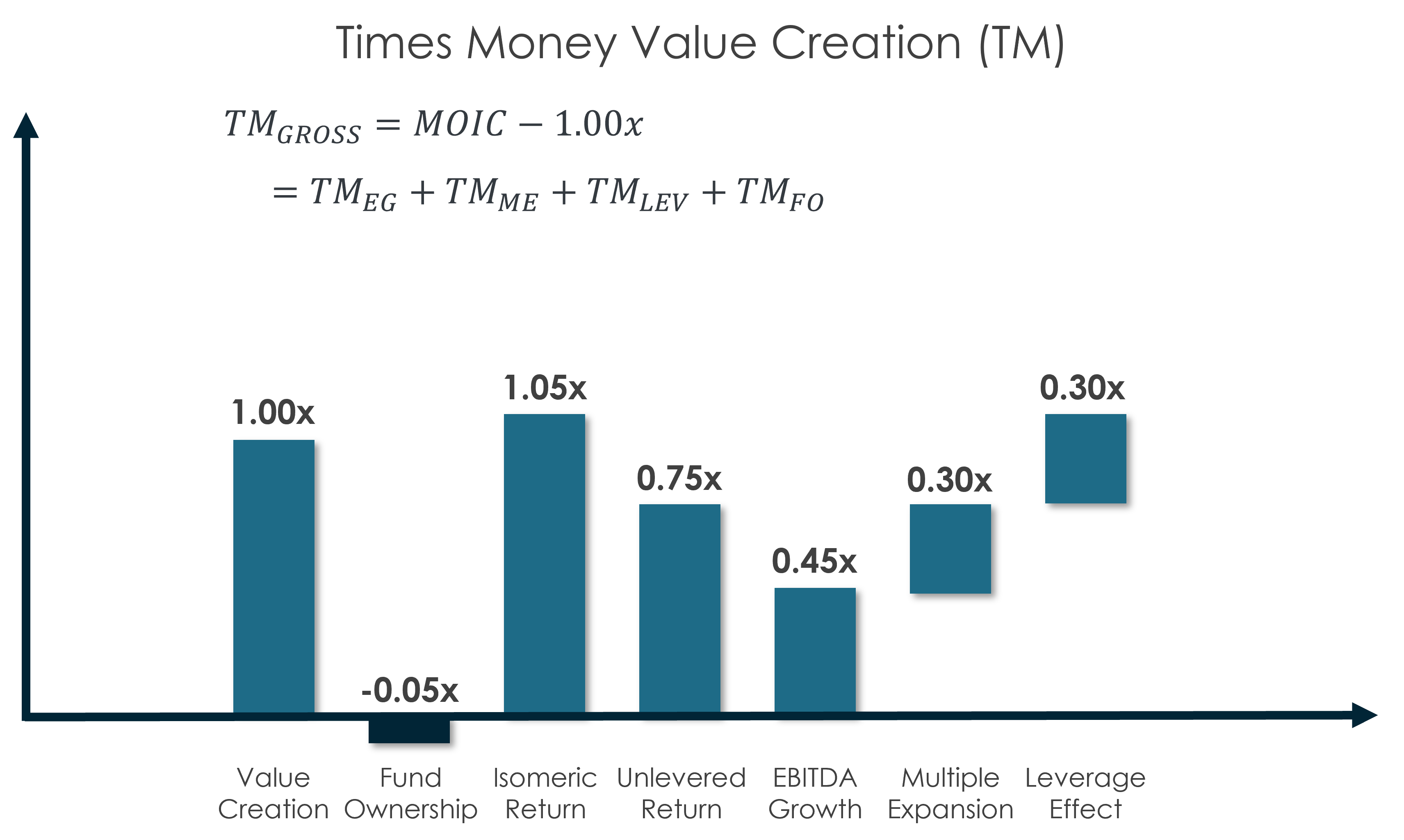

- Unlevered Return and the Leverage Effect

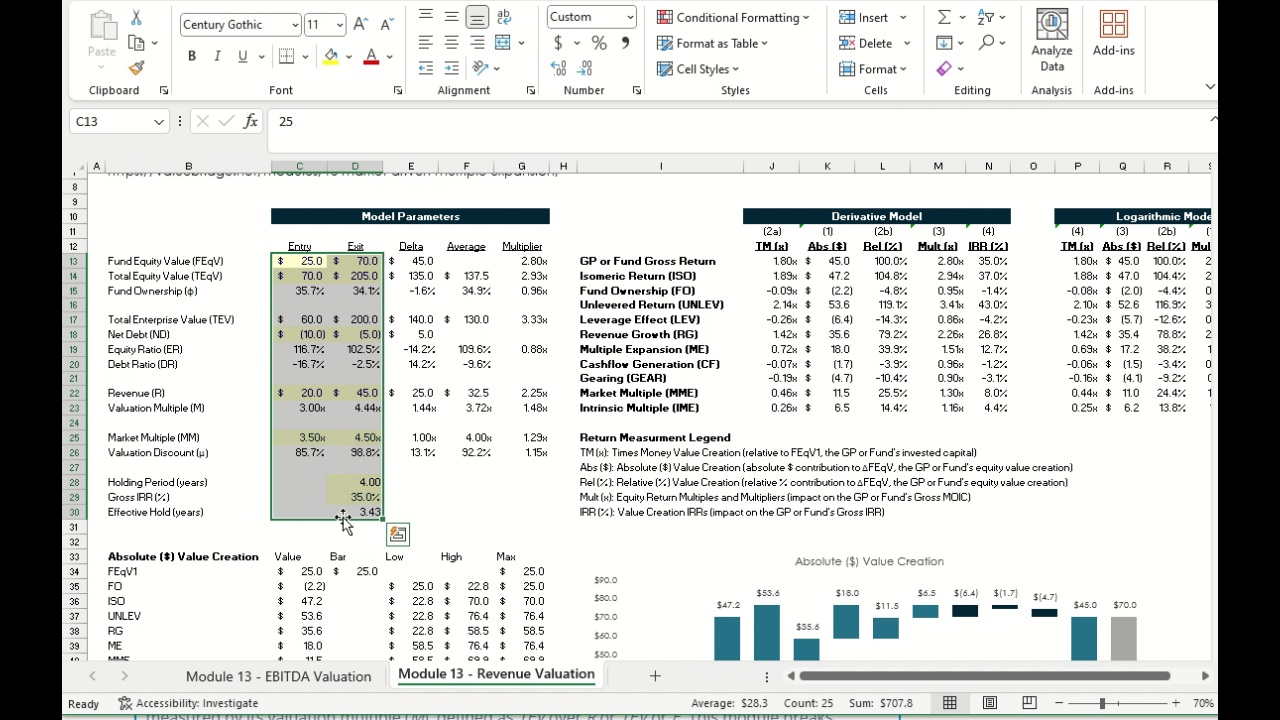

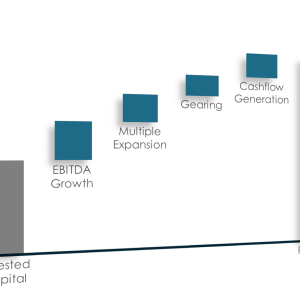

- EBITDA Growth and EBITDA Multiple Expansion

- Revenue Growth and Revenue Multiple Expansion

- Dependent and Independent Variables

- Five ways to Measure Private Equity Returns

- Gearing and Cashflow in an LBO

- Gearing and Cashflow in a Growth Investment

- Interest Costs and Debt Tax Shield

- Revenue Growth and EBITDA Margin Expansion

- Gross Margin Expansion and Operating Margin Reduction

- Market-driven Multiple Expansion

- Market Multiple Data Sources

- Market-driven Revenue Growth

- Addressable Market Data Sources

- Sector-appropriate Gearing

- Other Market Drivers

- Market versus Manager-driven Returns

- The Market Return Matrix

- Foreign Exchange Rates

- Five Mistakes that GPs Make

- Acquisition Adjustments (I)

- Acquisition Adjustments (II)

- Exit Adjustments (I)

- Exit Adjustments (II)

- Holding Period Inflows and Outflows

- Follow-on Equity Investments

- Equity Distributions

- Add-on Acquisitions

- Divestments

- Debt Financing

- Dividend Recapitalizations

- Earn Outs

- Multiple Holding Period Inflows and Outflows

- The Effective IRR

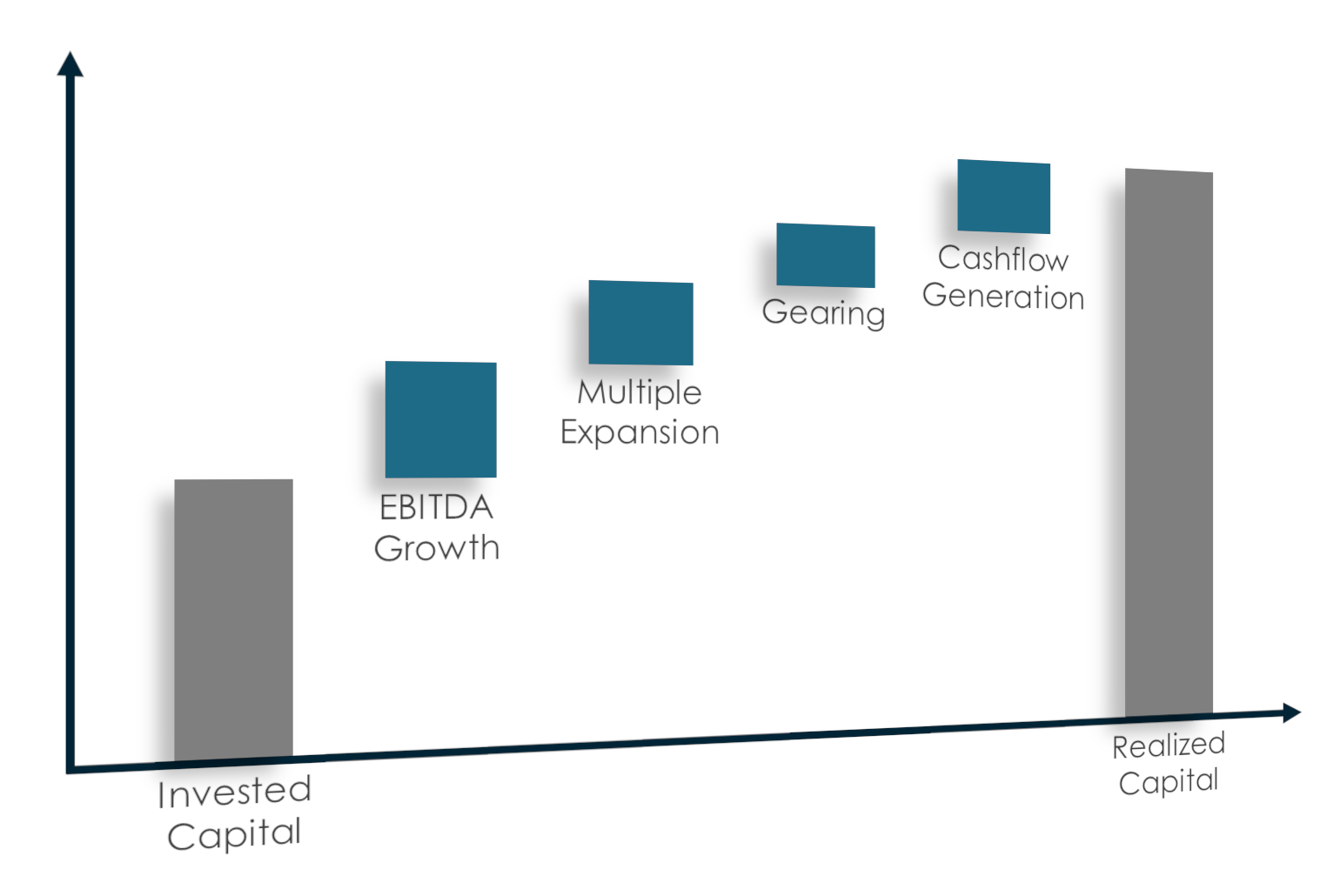

- Value Creation over Time

- Value Creation across Valuation Domains

- Aggregate Value Creation across Portfolios

- Net Return-based Value Drivers

Additional information

| Renewal Period | Annual, Quarterly, Monthly |

|---|