What is a value bridge?

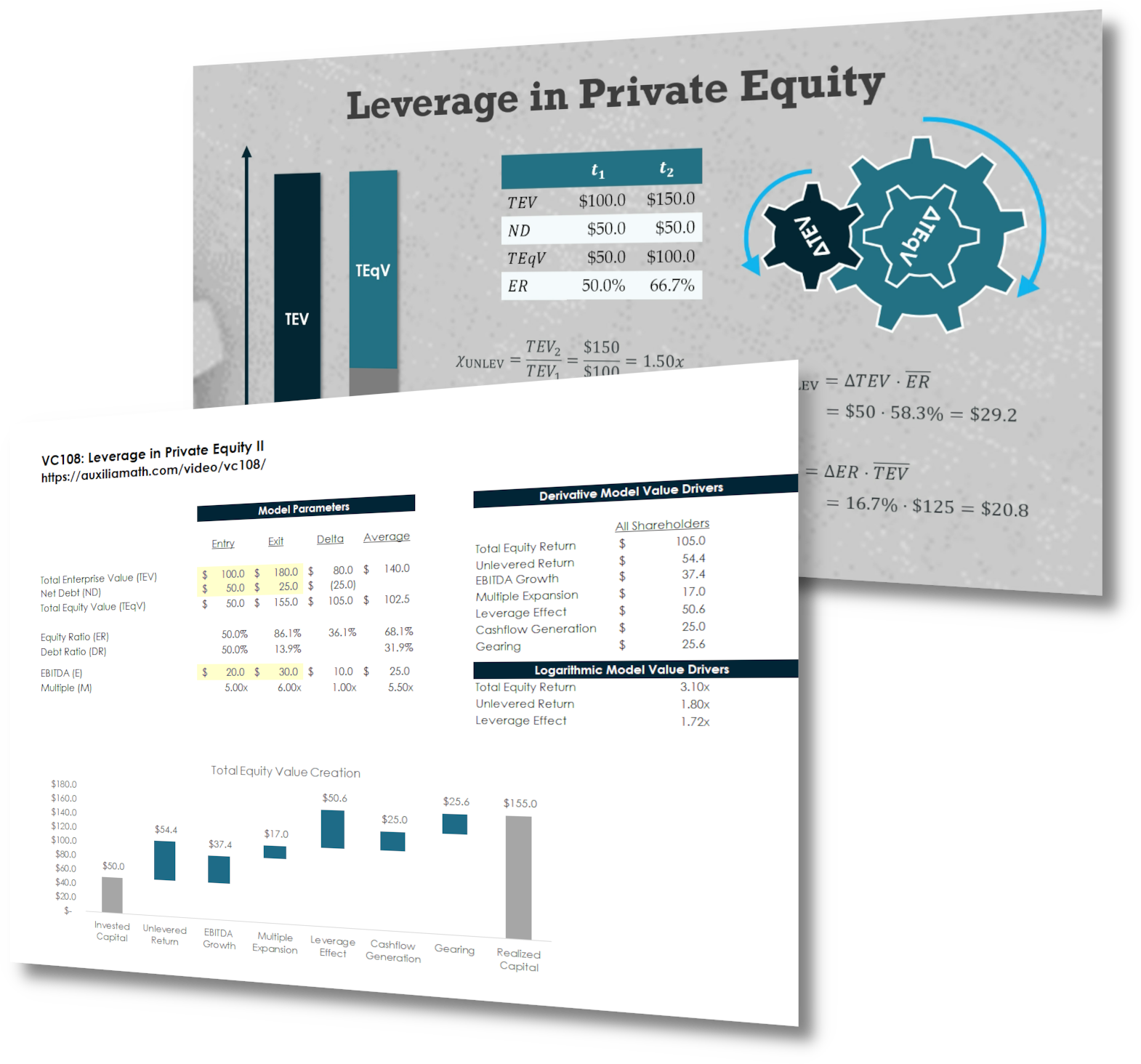

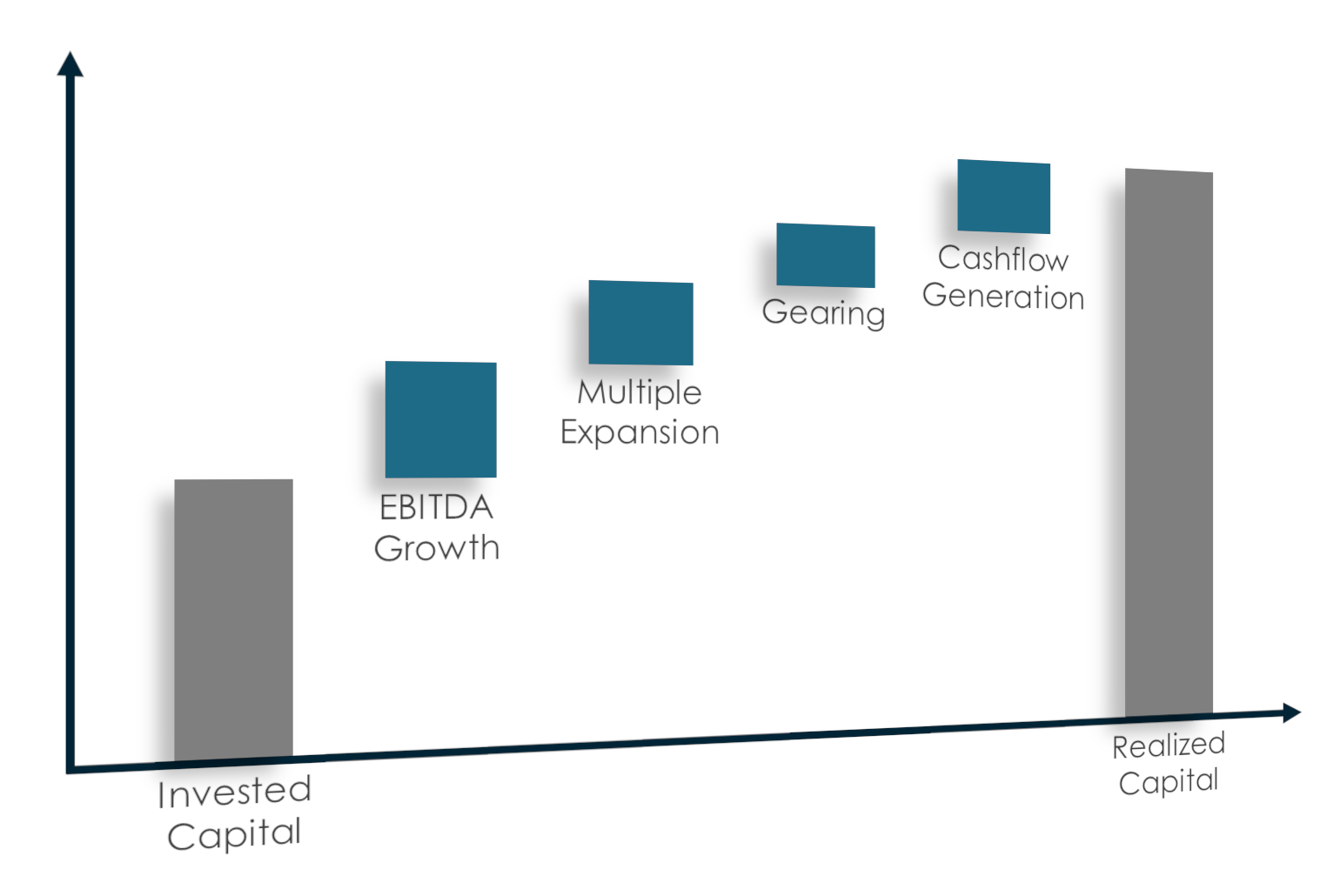

Value bridges explain how private equity returns are driven by changes in portfolio company P&Ls, capital structures, and market conditions. They are used by GPs to demonstrate investment strategies or operational capabilities, LPs to measure manager value-add, and academics to understand broader industry trends.

Despite 20 years of use in the industry, value bridge models utilized by GPs, LPs, and academics mostly fail. Their results are inconsistent and volatile, and they do not properly measure the impact of leverage and growth capital in private equity deals.

We proved that there is a better way

Adding a touch of Calculus 101 to the private equity portfolio company’s capital structure and P&L provides a robust mathematical framework that can be reliably applied to almost any deal. The math works for investments that are levered or unlevered, buyout or growth, majority or minority, 10x or 0.1x. Best of all, the models run on numbers already available in fund reporting and marketing materials.

We wrote a book about value bridges in 2020. Private Equity Value Creation Analysis is a top private equity book on Amazon.com. We also discuss these models extensively on our private equity mathematics website, AUXILIA Mathematica, and its companion YouTube page. There you’ll find detailed proofs and comparisons with other models in academic and industry literature, as well free Microsoft Excel templates.

Start building value bridges, today

You came to the right place if you need a defensible model up and running by close of business. Here, we exclude academic theories and mathematical proofs to provide just what’s essential to meet your deadline. Each of the 40 modules describes exactly which equations to use, where to find your numbers, and how to set up your spreadsheets.

No more guesswork!

All modules include short video demonstrations, downloadable Microsoft Excel templates, detailed notes and references, and online calculators that help you check your own models for errors. ValueBridge.net allows you build confidently, knowing your analyses will withstand scrutiny from the most inquisitive antagonists, whether they be your managing directors, limited partners, regulators, or the state treasurer.

SHORT VIDEO DEMONSTRATIONS

Learn exactly which equations to use, where to find data, and how to set up your spreadsheets, all in about 5-6 minutes.

MICROSOFT EXCEL TEMPLATES

Save time by starting with pre-built Microsoft Excel templates that are already optimized for your application.

ONLINE CALCULATORS

Ensure that your models are correct by checking against the site’s fail-proof online value creation calculators.

DETAILED NOTES AND REFERENCES

Build confidently by following step-by-step examples with clearly defined variables and equations.

Available Now!

Full access to available video instruction, Excel templates, online calculators, module notes, references, case studies, community forums, and support.

Check Content StatusPragmatic solutions to 40 private equity problems

Dive right into the module that best fits your situation or watch them all sequentially to thoroughly master the private equity value bridge.

01. Net MOIC and Net IRR

Calculate Net Returns from the Gross MOIC and Gross IRR and estimates for Management Fee, Fund Expense, and Carried Interest.

Free Access to Module 01