Decoding Value Creation Workshop

Original price was: $1,000.00.$599.00Current price is: $599.00.

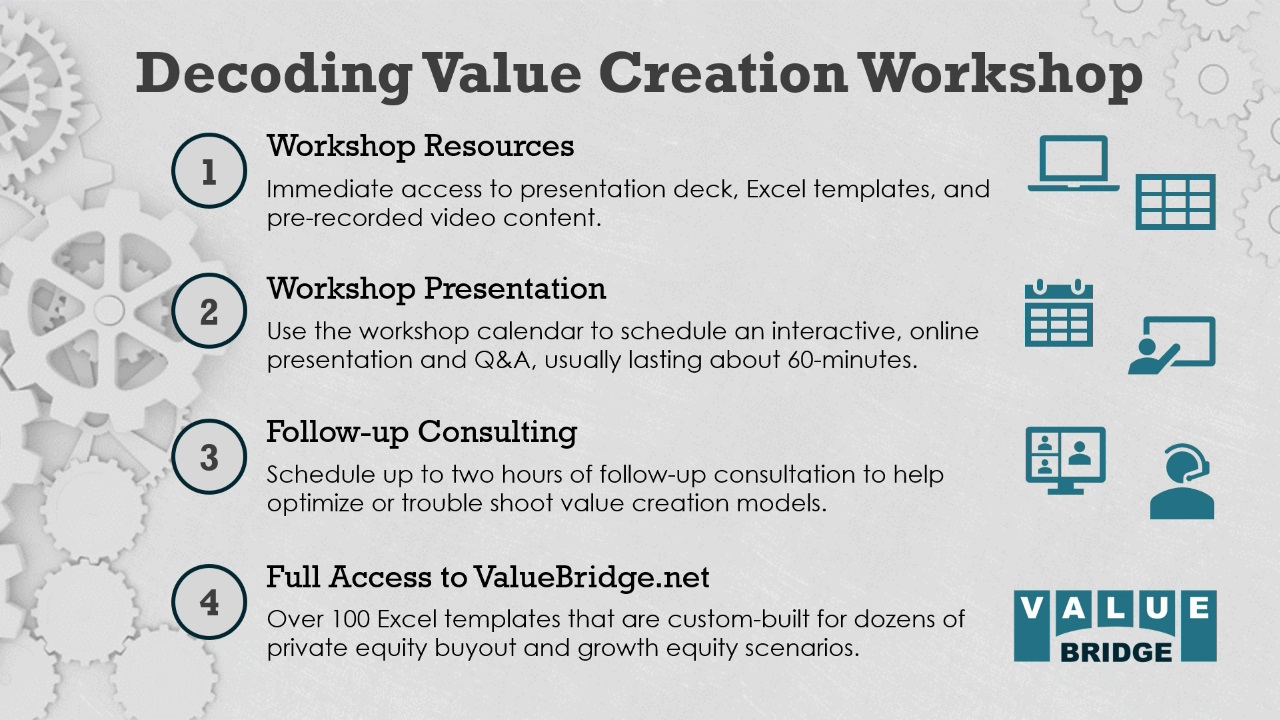

Schedule an interactive, online workshop that helps private equity marketing teams tell more interesting and credible stories about how they create value in buyout, growth, and venture capital investments. The workshop includes:

- An interactive, online presentation with Q&A (about 60 minutes)

- Up to two hours of follow-up consultation to optimize or trouble shoot models

- Immediate access to presentation deck, Excel templates, and pre-recorded video content

- One year of full-access to ValueBridge.net Analyst Edition content for up to three participants (valued at $540 USD)

Watch a 2.5-minute workshop overview here. Topics covered include:

- Using the Right Numbers

- Normalizing Leverage

- Understanding the Hierarchy

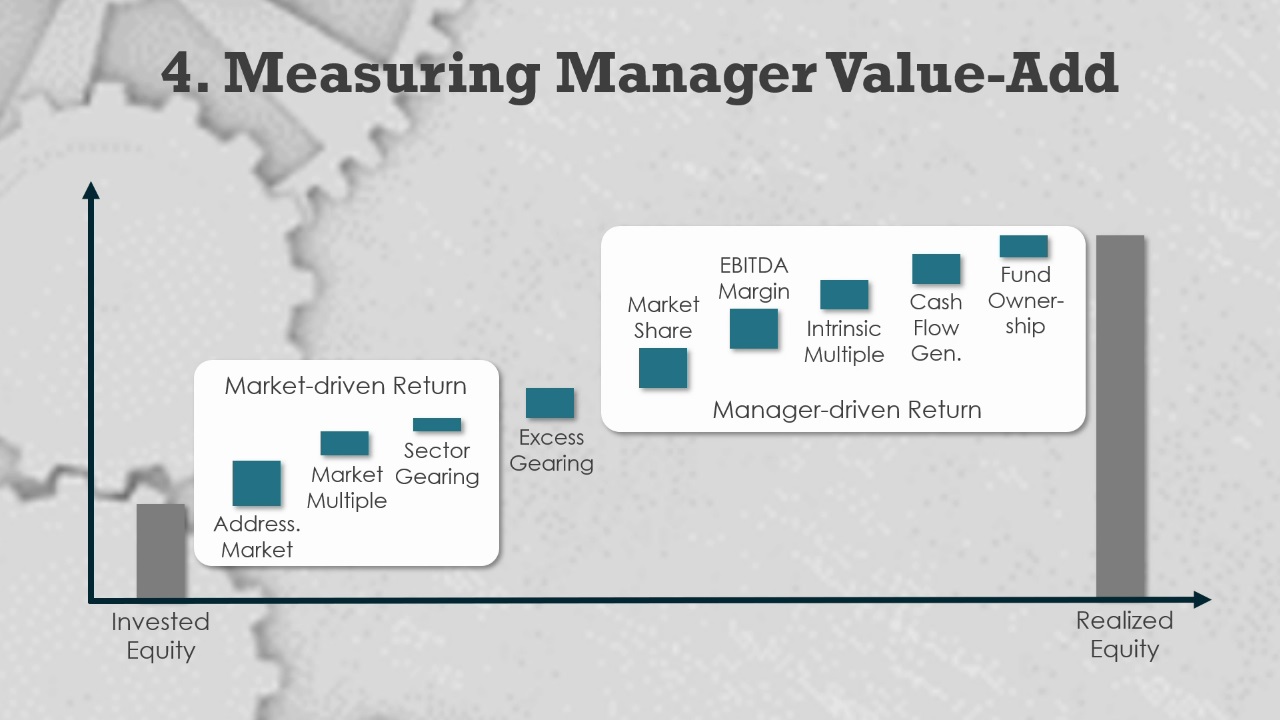

- Measuring Manager Value-Add

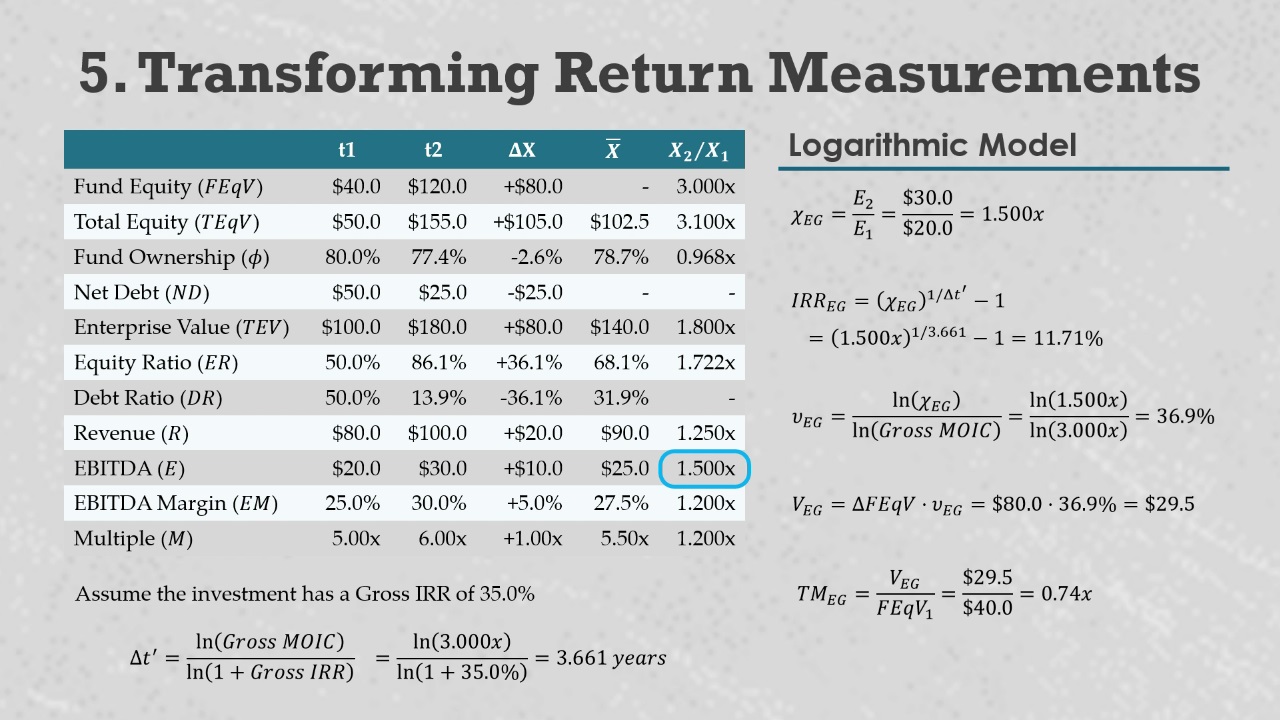

- Transforming Return Measurements

- Properly Adjusting for M&A

Description

Schedule an interactive, online workshop that helps private equity marketing teams tell more interesting and credible stories about how they create value in buyout, growth, and venture capital investments. The Decoding Value Creation workshop includes:

- An interactive, online presentation with Q&A (about 60 minutes)

- Up to two hours of follow-up consultation to optimize or trouble shoot models

- Immediate access to presentation deck, Excel templates, and pre-recorded video content

- One year of full-access to Analyst Edition content for up to three participants (valued at $540 USD)

This new crash course shows buyout, growth, and venture funds how to use portfolio company financial metrics to illustrate investment skills and operational value-add. Watch a 2.5-minute workshop overview here.

Topics covered in the Decoding Value Creation workshop include:

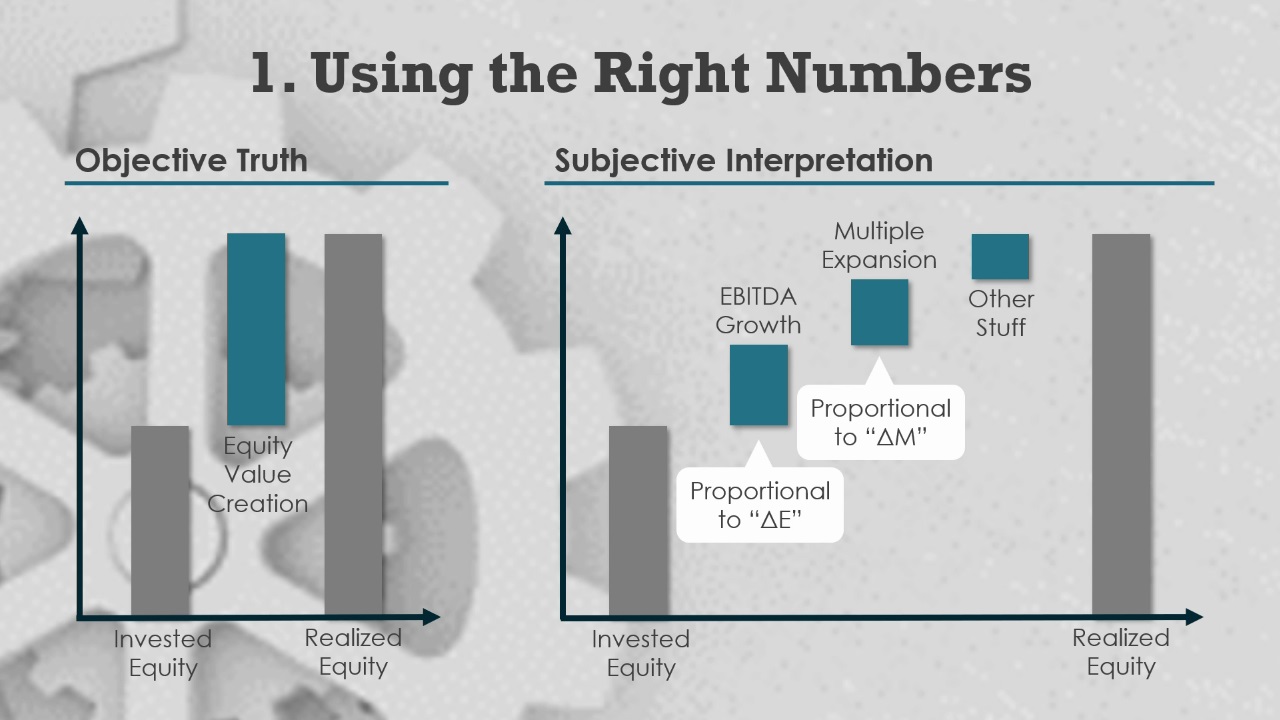

1. Using the Right Numbers: Maximize your apparent skill as an investor and operator by sending the right portfolio company financial metrics to prospective Limited Partners.

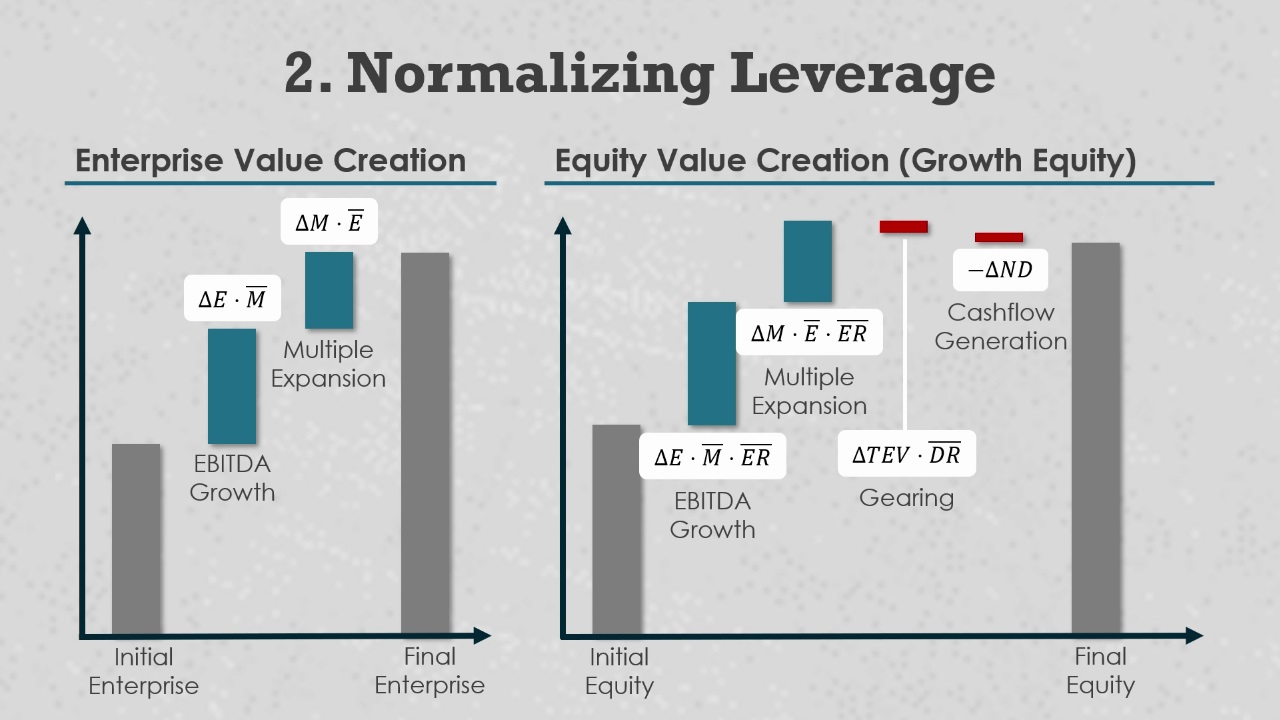

2. Normalizing Leverage: Precisely quantify gains or losses from amplifying equity returns with debt, de-levering capital structures, and using equity to fund growth initiatives.

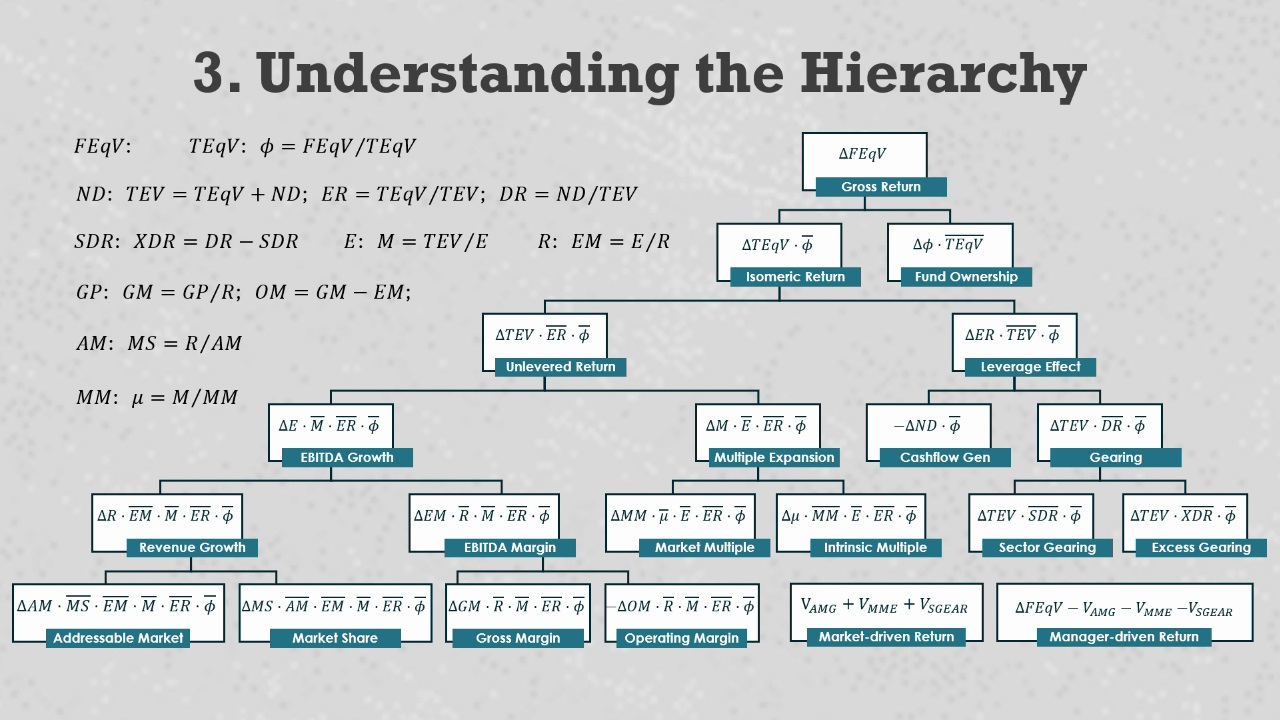

3. Understanding the Hierarchy: Design robust value creation models that reliably measure how equity returns come from movements in underlying portfolio company financials and broader market metrics.

4. Measuring Manger Value-Add: Calculate equity returns driven by improving market share, EBITDA margins, quality of revenue or earnings, and cash management, as well as equity structuring mechanics.

5. Transforming Return Measurements: Convert any absolute ($) value driver into capital- or time-dependent measurements like times money value creation, equity return multipliers, or value creation IRRs.

6. Properly Adjusting for M&A: Incorporate add-on acquisitions, asset sales and purchases, support equity investments, dividend recapitalizations, and other financing and M&A activities into value creation models.

Following purchase, participants receive calendar links to schedule the workshop presentation and follow-up calls. They can immediately access the workshop presentation deck, a Microsoft Excel template that demonstrates all models and mathematics, and a pre-recorded version of the presentation that may be previewed in advance or reviewed after the scheduled workshop.

Additionally, the participants gain access to 100+ Microsoft Excel templates that are custom-built for dozens of private equity buyout and growth equity scenarios and supported by step-by-step written instructions, video demonstrations, and online error-checking tools.