Educator Edition

$1,000.00

Coming soon…

A full semester of student access to video instruction, Excel templates, online calculators, notes & references, and case studies. Read-only access to community forums. Up to 50 students per school or class.

Out of stock

Description

A full semester of student access to video instruction, Excel templates, online calculators, notes & references, and case studies. Read-only access to community forums. Up to 50 students per school or class.

ValueBridge.net Modules:

- Net MOIC and Net IRR

- Equity Dilution and Equity Concentration

- Unlevered Return and the Leverage Effect

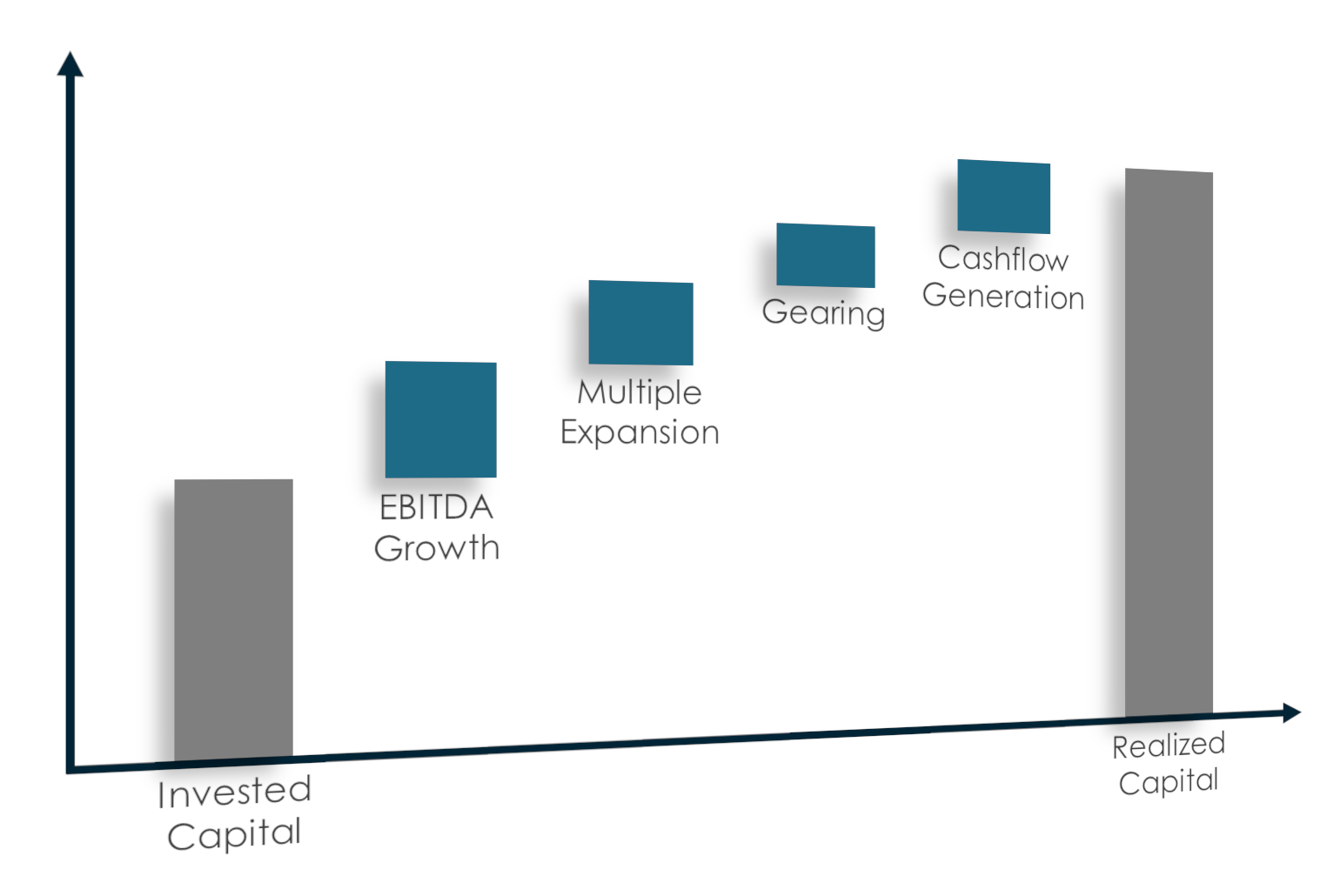

- EBITDA Growth and EBITDA Multiple Expansion

- Revenue Growth and Revenue Multiple Expansion

- Dependent and Independent Variables

- Five ways to Measure Private Equity Returns

- Gearing and Cashflow in an LBO

- Gearing and Cashflow in a Growth Investment

- Interest Costs and Debt Tax Shield

- Revenue Growth and EBITDA Margin Expansion

- Gross Margin Expansion and Operating Margin Reduction

- Market-driven Multiple Expansion

- Market Multiple Data Sources

- Market-driven Revenue Growth

- Addressable Market Data Sources

- Sector-appropriate Gearing

- Other Market Drivers

- Market versus Manager-driven Returns

- The Market Return Matrix

- Foreign Exchange Rates

- Five Mistakes that GPs Make

- Acquisition Adjustments (I)

- Acquisition Adjustments (II)

- Exit Adjustments (I)

- Exit Adjustments (II)

- Holding Period Inflows and Outflows

- Equity Infusions

- Equity Distributions

- Add-on Acquisitions

- Divestments

- Debt Refinancings

- Dividend Recapitalizations

- Earn Outs

- Multiple Holding Period Inflows and Outflows

- The Effective IRR

- Value Creation over Time

- Value Creation across Valuation Domains

- Aggregate Value Creation across Portfolios

- Net Return-based Value Drivers