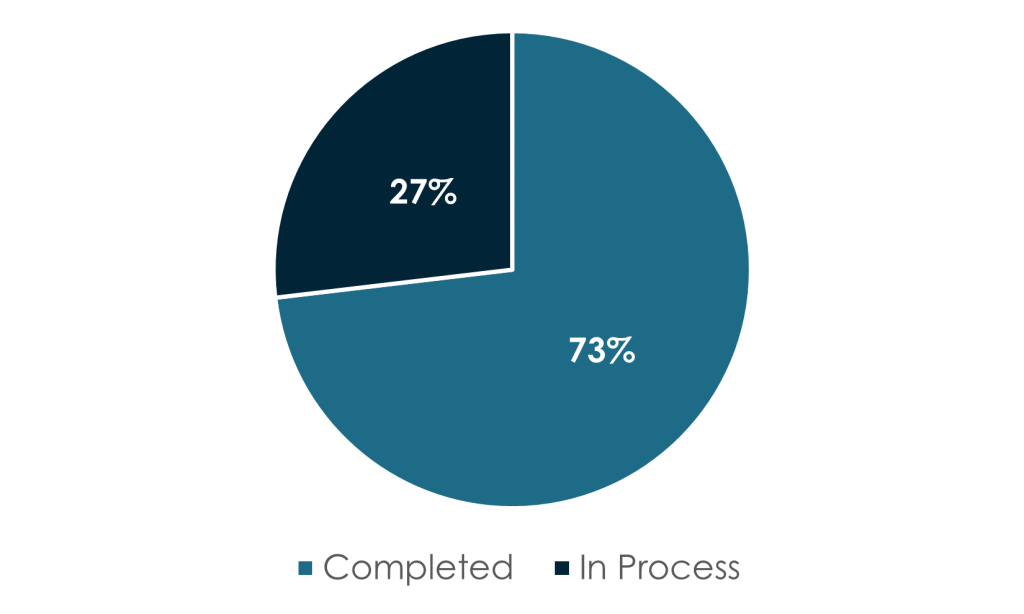

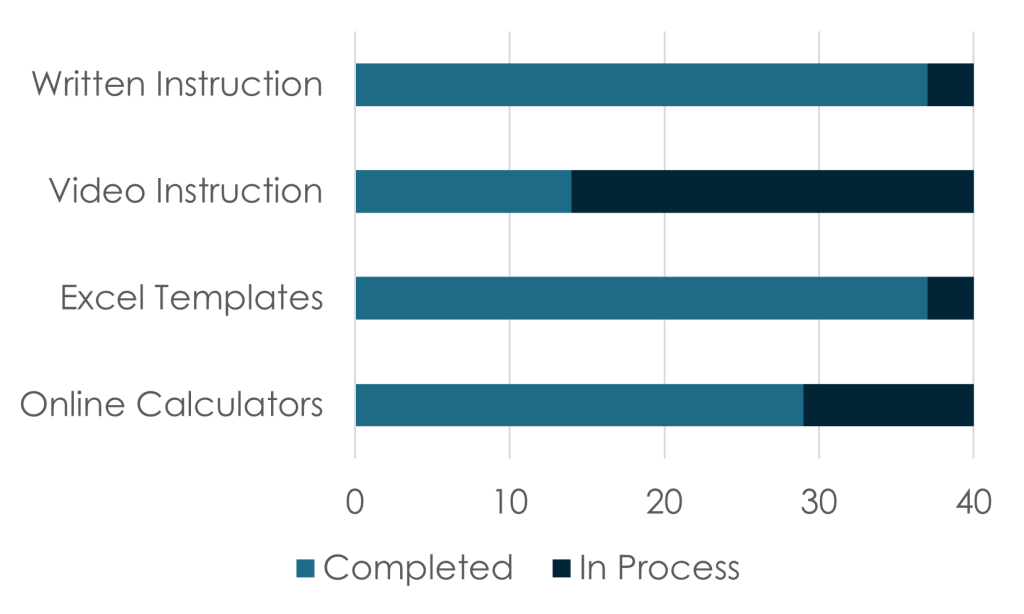

Over 70% of ValueBridge.net content is already complete. Nearly all of the Microsoft Excel Templates are available and written instruction, with step-by-step examples, has been provided for more than 90% of the first 40 ValueBridge.net Modules. Video instruction is available for all the major value drivers related to investment performance, capital structures, and broader market forces. Additional content is being added every month.

Total Content Status

Module Component Status

Module Component Details

Published and Anticipated Case Studies

Case Study | Write-up | Video | Excel Template | |

|---|---|---|---|---|

| Why Value Bridges need an Equity Dilution or Concentration Value Driver | ✅ | ✅ | ✅ | |

| How to Fix a Broken Value Bridge | ✅ | ✅ | ✅ | |

| A Cross Border Value Bridge | ✅ | ✅ | ✅ | |

| Quick Cross Border Value Bridge | ✅ | ✅ | ✅ | |

| Cross Border Return Matrix | ✅ | ✅ | ✅ | |

| ESG Trade-offs: SG&A vs. Valuation | ✅ | ✅ | ✅ | |

| ESG Trade-offs: Margins vs. Revenue | ✅ | ✅ | ✅ | |

| A Value Bridge for Lower Middle Market Manufacturing | ||||

| Lower Middle Market Manufacturing Return Matrix | ||||

| Portfolio Return Models with Recycling Adjustments | ||||

| Portfolio Return Models where LPs have Different Terms | ||||

| Portfolio Return Models with Fund Credit Facility Adjustments | ||||

| Calculating Carried Interest in the Catch-up Period | ||||

| More to come… |