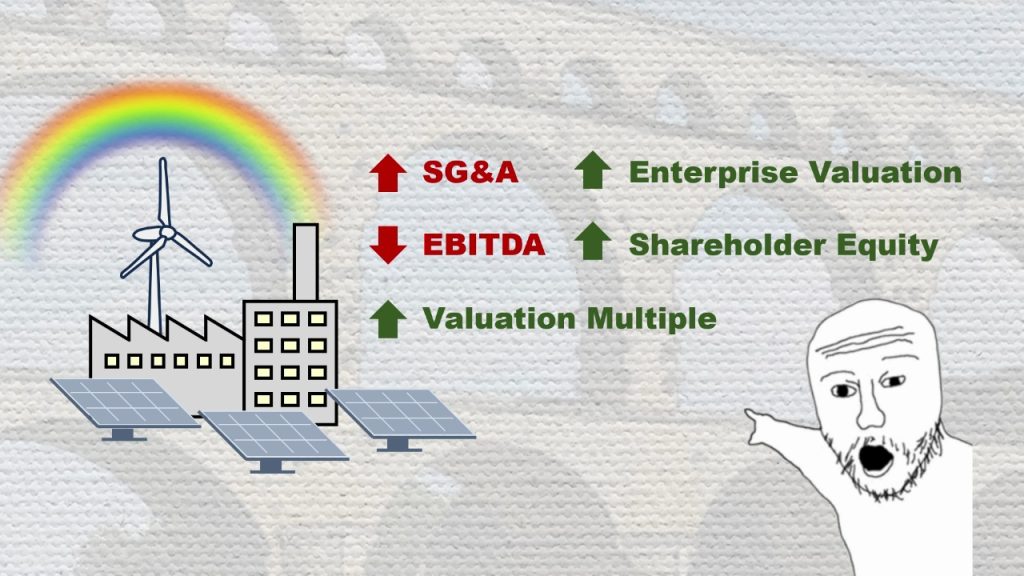

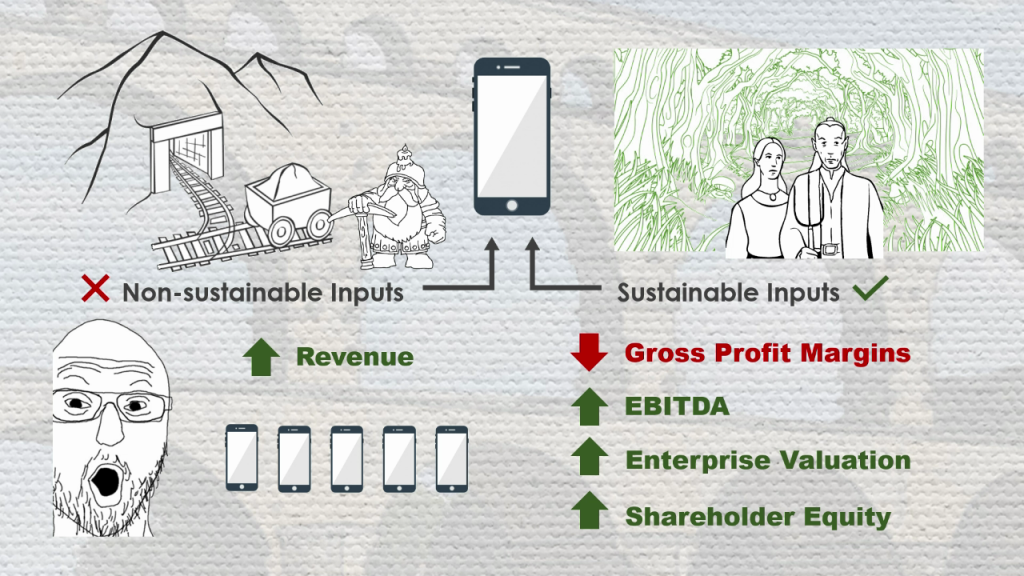

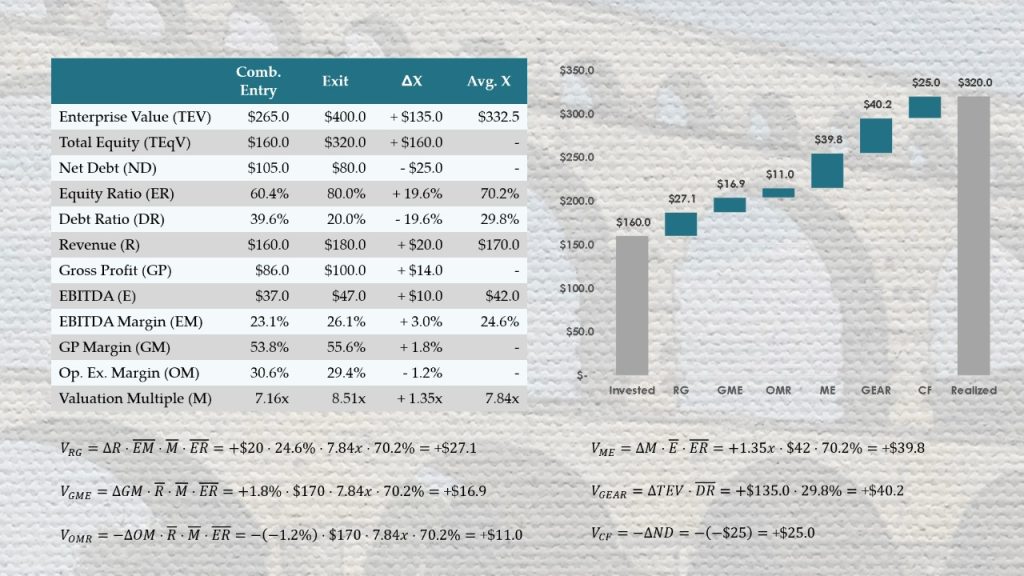

These private equity case studies provide examples of the ValueBridge.net models solving real-world problems. So far we have covered quick corrections that can fix broken value bridges, cross-border deals that require foreign exchange rate adjustments, quantifying the impact various ESG initiatives, value creation in buy-and-build or roll-up strategies, and the potential impact of tariffs.

Most case studies include Microsoft Excel downloads that are available to ValueBridge.net subscribers. Use them to develop a better understanding of the math, or as templates to add new content to your fundraising pitchbook, annual meeting presentation, or PPM.

Feel free to get in touch with me through the support page or my consulting website if you need additional help or bandwidth updating your private equity marketing or analysis content, including track record and value creation models.